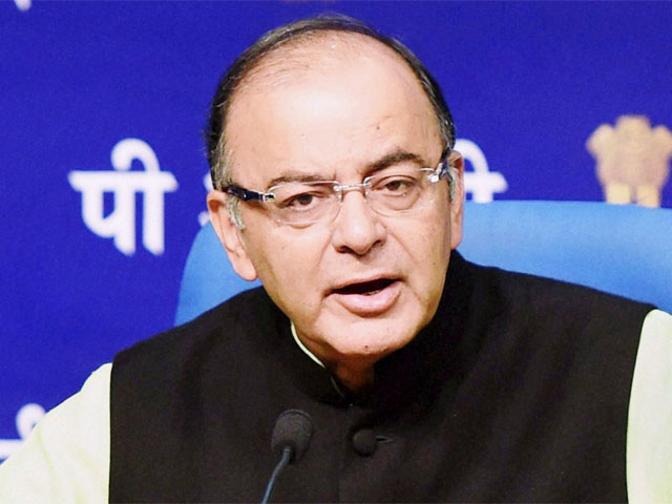

Rs 19,000 cr black money detected by I-T in ICIJ, HSBC cases, says Jaitley

Sat 22 Jul 2017, 10:06:57

The Income Tax department has detected over Rs 19,000 crore in black money following investigations into global leaks including HSBC account holders in Switzerland, the government said today.

Finance Minister Arun Jaitley said investigations into information, put into public domain by the ICIJ, pertaining to about 700 Indian persons allegedly linked to offshore entities based on no tax or low tax jurisdiction, have led to the detection of more than Rs 11,010 crore of credits in undisclosed foreign accounts.

"72 prosecution complaints in 31 such cases have been filed before the criminal courts," he informed the Lok Sabha.

The government constituted a multi-agency group (MAG) in April 2016 for facilitation coordinated and speedy investigation in the cases of Indian persons allegedly having undisclosed foreign assets and whose names were reportedly included in Panama papers leak.

He further said that information on 628 Indian persons holding bank accounts in HSBC bank in Switzerland was received from the government of France under the Double Taxation Avoidance Convention (DTAC) between

India and France.

India and France.

"As a result of the systematic investigation in these cases, undisclosed income of about Rs 8,437 crore was brought to tax till May 2017.

"Besides, concealment penalty of Rs 1,287 crore was levied in 162 cases and 199 criminal prosecution complaints were filed in 84 cases," Jaitley pointed out.

He noted however that the information received under the tax treaties can be used for tax purposes and its disclosure is governed by the confidentiality provisions of such treaties.

Replying to a query, whether the government has made any assessment of black money stashed by Indians in foreign countries, Jaitley said there is no official estimation of that.

However, he said, the government had commissioned a study on estimation of unaccounted income and wealth inside and outside the country to be conducted by NIPFP, NIFM and NCAER.

"The reports of these institutions and the government's response to the findings in the reports would be placed before the Standing Committee on Finance shortly," he added.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Do you think Canada-India relations will improve under New PM Mark Carney?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.