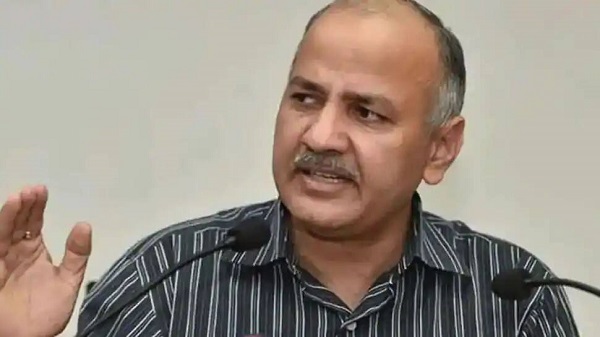

Delhi Finance Minister says, in 45th GST Council meet, Not right time to bring petrol, diesel under GST regime:

Fri 17 Sep 2021, 21:01:26

Delhi Finance Minister Manish Sisodia said at the 45th GST Council meet held in Lucknow on September 17 that this is not the right time to decide if petrol and diesel should be brought under the Goods and Services Tax (GST) regime.

Sisodia added that a "lot of revenue considerations are involved and more discussion on the topic is needed" before any changes are introduced.

Meanwhile, Finance Minister Nirmala Sitharaman, who chaired the first in-person GST Council meet held since the outbreak of the coronavirus pandemic, said: "The issue of petrol and diesel was discussed. Several states said they do not want to bring these under GST. It was decided that the Council should report to Kerala High Court that the matter was discussed. The Council felt it was not time to bring petrol and diesel under GST."

Central excise and state VAT (Value Added Tax) make up for almost half of the retail selling price of petrol and diesel. Bringing them under the GST would impact revenue generation for the states.

Petrol & Diesel Rates Yesterday

Thursday, 16th September, 2021

Petrol Rate in Mumbai Yesterday

Current Petrol Price Per Litre

₹107

Thursday, 16th September,

2021

2021

Diesel Rate in Mumbai Yesterday

Current Petrol Price Per Litre:

₹96

Show

If petrol and diesel come under the GST regime, prices will become mostly uniform across all states as the different excise and VAT rates that the Centre and the states impose would then be done away with. This would help bring down diesel and petrol prices greatly, which has touched new highs in the recent past.

However, a huge chunk of revenue of both the Centre and states come from the tax collected from petrol and diesel sale and if a uniform GST is levied, the amount will have to be shared equally between the state governments and the central government.

With these factors in mind, Maharashtra Deputy Chief Minister and Finance Minister Ajit Pawar also said that if the tax structure is altered by the Union government in a way that adversely impacts the states' revenue, the move will be opposed.

A day ahead of the GST Council meeting, even the Kerala government had said that it will vehemently oppose any move to bring petrol and diesel under the GST regime as that will further reduce revenue generation for the state and asserted that the Centre should reduce its levies on the two commodities to provide relief to the common people.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

AIMIM News

Asaduddin Owaisi questions PM Modi's China policy

Jan 08, 2025

Owaisi slams UP over police post near Sambhal mosque

Dec 31, 2024

Owaisi hails SC order on Places of Worship Act

Dec 13, 2024

AAP Corporator Tahir Hussain joins AIMIM party

Dec 11, 2024

Latest Urdu News

Most Viewed

May 26, 2020

Which political party will win the Delhi Assembly polls to be held on Feb 5?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.