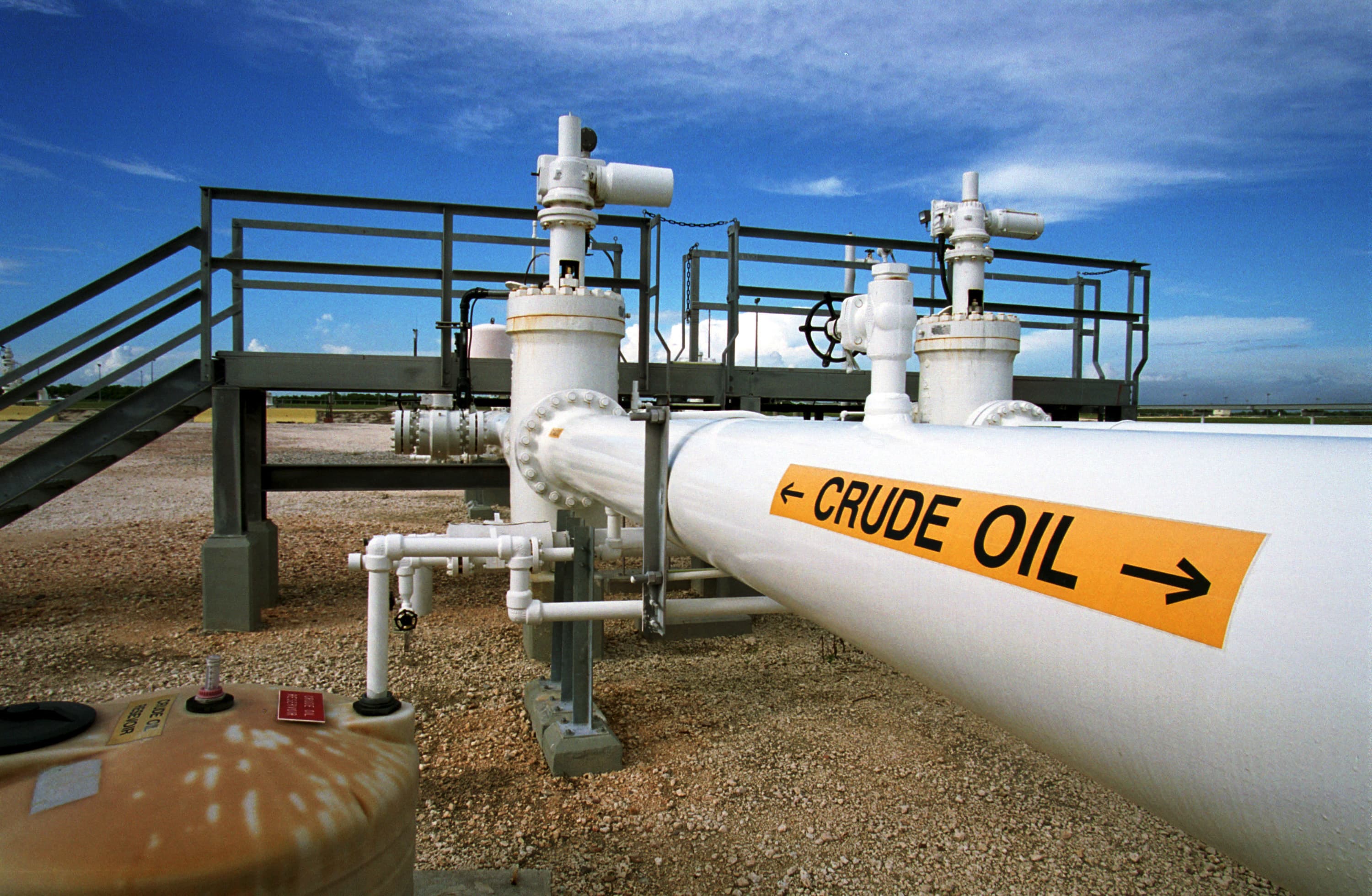

Global crude oil prices drop to 82.17 dollars per barrel

Mon 15 Nov 2021, 11:15:26

Global crude oil prices fell for a third consecutive week, hit by a strengthening dollar and speculation that President Joe Biden's administration might release oil from the US Strategic Petroleum Reserve to cool down prices.

Brent crude oil futures fell 0.7% during the week to end at 82.17 dollars a barrel on Friday, while US crude declined 0.6% during the week to settle at 80.79 dollars.

US Energy Secretary Jennifer Granholm said that Biden could act as soon to address soaring gasoline prices. US energy firms this week added oil and natural gas rigs for a third week in a row. The oil and gas rig count, an early indicator of future output, rose six to 556 in the week to Nov. 12, its highest level since April 2020.

Russia's Rosneft the world's

second-biggest oil company by output after Saudi Aramco, warned on Friday of a potential "super cycle" in global energy markets, raising the prospect of even higher prices as demand outstrips supply.

second-biggest oil company by output after Saudi Aramco, warned on Friday of a potential "super cycle" in global energy markets, raising the prospect of even higher prices as demand outstrips supply.

Still, though there are positive signs on the demand side, with air travel picking up rapidly, tighter monetary and fiscal policy and the looming Northern Hemisphere winter will act as a dampener.

The OPEC on Thursday cut its world oil demand forecast for the fourth quarter by 330,000 barrels per day (BPD) from last month's forecast as high energy prices hampered economic recovery from the COVID-19 pandemic. OPEC, Russia, and allies, together known as OPEC, agreed last week to stick to plans to add 400,000 BPD to the market each month.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

AIMIM News

Delhi Assembly polls: Owaisi leads Padyatra in Okhla

Feb 01, 2025

We reject this Waqf Amendment Bill: Asaduddin Owaisi

Jan 30, 2025

Latest Urdu News

Most Viewed

May 26, 2020

Do you think Canada-India relations will improve under New PM Mark Carney?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.