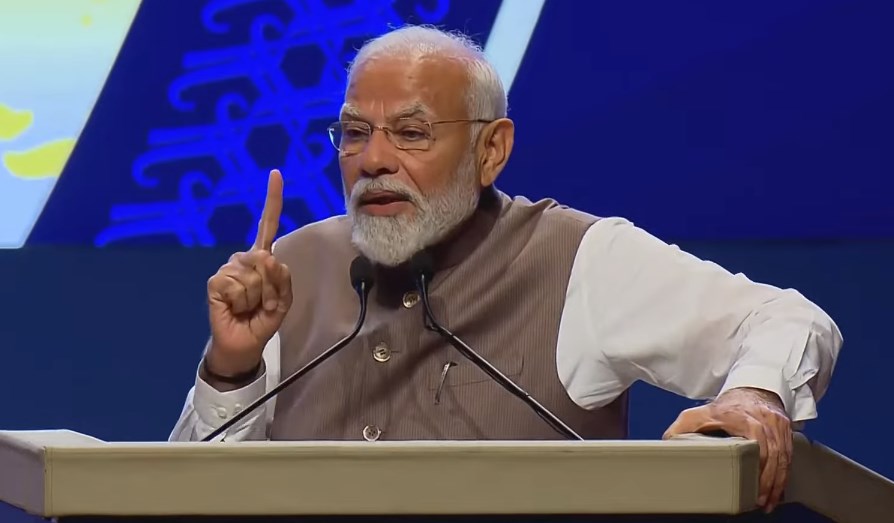

India Needs To Become Economically Self-Reliant In Next 10 Years: PM Modi

Tue 02 Apr 2024, 10:41:31

Mumbai: Prime Minister Narendra Modi yesterday said that India needs to become economically self-reliant in the next 10 years so that the nation is not impacted much by the global factors. Speaking at the commemoration ceremony of the 90 years of the Reserve Bank of India (RBI) in Mumbai, the Prime Minister said the transformation of Indian banking sector is a case study. He said the banking sector has become profitable and credit growth has been increasing due to the steps taken by his government and the RBI in the last decade.

He said, the government infused capital of 3.5 lakh crore rupees in PSU banks for their revival. He further said the gross Non-Performing Assets (NPAs) of public sector banks, which was around 11.25 per cent in 2018, dropped to less than 3 per cent by September last year. Mr Modi added that the twin-balance sheet problem is now a thing of the past, adding that banks are now registering a credit growth of 15 per cent.

The Prime Minister said, the RBI has played a significant role in all these accomplishments. He said, RBI is known in the world for its professionalism and commitment. He said, the central bank has been able to stabilise G-sec yields despite monetary tightening and has also been successful in anchoring inflationary expectations. Prime Minister Modi was on a day-long visit to the

city.

city.

Union Finance Minister Nirmala Sitharaman and Ministers of State for Finance Bhagwat Kishanrao Karad and Pankaj Chaudhary also participated in the programme.

Speaking on the occasion, RBI Governor Shaktikanta Das said, the Reserve Banks’ evolution as an institution has been closely intertwined with the development of the Indian economy. He said, from being a central bank primarily concerned with allocation of scarce resources during the planning period, the RBI has transitioned into being an enabler for the market economy.

Maharashtra Chief Minister Eknath Shinde and Deputy Chief Ministers Devendra Fadanvis and Ajit Pawar and representatives of various banks and industry leaders took part in event. The Reserve Bank of India (RBI) commenced its operations on 1st of April in 1935.

Addressing the gathering, Union Finance and Corporate Affairs Minister Nirmala Sitharaman said, during COVID pandemic, the RBI adopted and deployed conventional and unconventional range of instruments to provide liquidity, promote growth and to ensure financial stability. She added that during the Russia-Ukraine conflict, the measures taken by the Central Bank helped in addressing the inflation and the forex market volatility.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

AIMIM News

Delhi Assembly polls: Owaisi leads Padyatra in Okhla

Feb 01, 2025

We reject this Waqf Amendment Bill: Asaduddin Owaisi

Jan 30, 2025

Latest Urdu News

Most Viewed

May 26, 2020

Which team will win the ICC Men's Champions Trophy 2025 held in Pakistan/Dubai?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.