Nifty closes at all-time high of 9,306.60 points, valuations rich

Tue 25 Apr 2017, 22:18:36

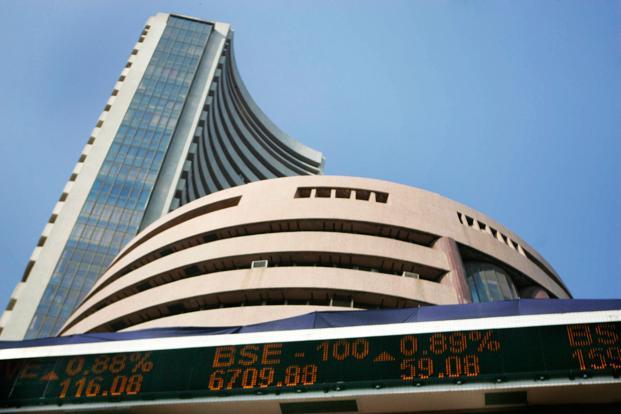

Mumbai: The National Stock Exchange's (NSE's) benchmark Nifty rose to a record closing high on Tuesday and the BSE Sensex ended just 57 points short of the psychologically important mark of 30,000 as better-than-expected quarterly corporate earnings and the forecast of a normal monsoon buoyed investors.

Rich stock valuations failed to deter investors, who also rode the tail of a worldwide rally sparked by a centrist victory in the first round of the French presidential election.

The 50-share Nifty closed 88.65 points, or 0.96%, higher at 9,306.60 points on Tuesday. The 30-share Sensex closed up 287.40 points, or 0.97%, at 29,943.24 points.

"Overall sentiment is very supportive for emerging markets," said Hertta Alava, the Helsinki, Finland-based director of emerging market funds at FIM Asset Management Ltd, in an emailed response to questions. "In France, Mr. (Emmanuel) Macron will most likely become the next president, which is supporting euro, and dollar has started to weaken. Dollar weakness is usually positive for EM. Inflows to emerging market funds will probably continue and India will get its share."

Elsewhere, the Nasdaq Composite index crossed the 6,000 threshold on Tuesday, more than 17 years after it last marked a 1,000 point milestone.

The Sensex has gained 12.46% so far this year, logging the highest gain among Asian equity indices, and is also the top gainer among peers in the so-called BRIC grouping of Brazil, Russia, India and China.

Foreign institutional investors (FIIs) have pumped nearly $6 billion into Indian shares since the start of the year until Friday, but have sold a net of $173.29 million (around Rs1,115 crore) shares in the first 13 sessions of April. On Tuesday, FIIs and domestic institutional investors bought Rs178.82 crore and Rs998.26 crore

of Indian shares, respectively, according to provisional data from NSE.

of Indian shares, respectively, according to provisional data from NSE.

The record rally has pushed up valuations for stocks, with the Nifty currently trading at 17.21 times one-year forward earnings, higher than the five-year average of 14.77 times.

This has made investors such as Gautam Duggad, head of research at Motilal Oswal Financial Services Ltd, cautious.

Going ahead, the sustainability of corporate results momentum and, more importantly, management commentary about the current financial year's earnings prospects will be key factors as valuations do not offer much comfort, Duggad said.

Yet, for others, valuations are not a big concern, and they believe the Indian market could head further north in the days to come.

"The Indian equity market can continue to rise, driven by global risk appetite towards emerging market assets in general with the improving India growth picture and the favourable domestic fund flow dynamics," said Maarten-Jan Bakkum, the Hague, Netherlands-based senior emerging markets strategist at NN Investment Partners, which manages €8 billion in emerging market assets.

"Valuations are rich, but they can become richer,"said Bakkum.

Tuesday's rally was market wide, with the Bank Nifty and Nifty Midcap also recording new highs. The BSE500, BSE Midcap, BSE Smallcap, BSE basic materials, BSE consumer discretionary goods & services, BSE consumer durables, BSE finance, BSE industrials and BSE utilities indices also logged record highs in intra-day trade.

Reliance Industries Ltd rose as much as 3.43% to Rs1,465, its highest level since 18 January 2008, after the company reported a better-than-expected 12.3% increase in its consolidated March-quarter profit. It pared some gains and closed 1.14% higher at Rs1,432.50.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Do you think Canada-India relations will improve under New PM Mark Carney?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.