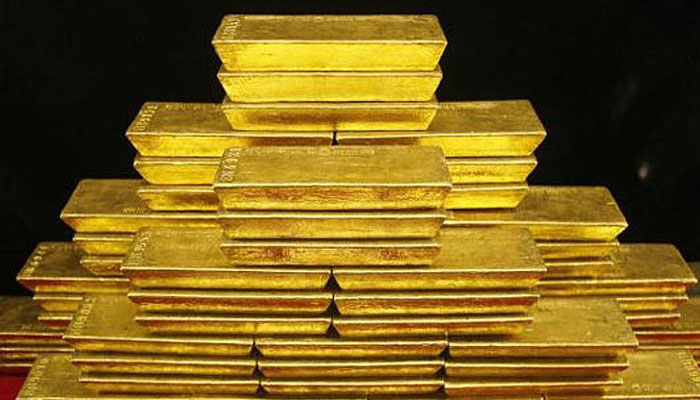

RBI amends Gold Monetisation Scheme to make it more attractive

Fri 08 Jun 2018, 12:01:29

The Reserve Bank of India (RBI) has made changes in the Gold Monetisation Scheme (GMS) of 2015 to enable people to open a hassle-free gold deposit account. In a notification issued yesterday, RBI said that the short-term deposits should be treated as bank's on-balance sheet liability.

It further said that these deposits will be made with the designated banks for a short period of 1-3 years (with a facility of rollover). While deposits can also be allowed for broken periods (e.g. 1 year 3 months; 2 years 4 months 5 days or other.

RBI added that the interest rate payable in the case of deposits for maturities with broken periods should be calculated as the sum of interest for the completed year plus interest for the

number of remaining days.

number of remaining days.

In 2015, the government launched the GMS with the objective of mobilising the gold held by households and institutions in the country.

The apex bank also said that the Medium Term Government Deposit (MTGD) can be made for 5-7 years and Long-Term Government Deposit (LTGD) for 12-15 years or for such period as may be decided by the Central Government from time to time. Deposits can also be allowed for broken periods (e.g. 5 years 7 months; 13 years 4 months 15 days; etc.).

The scheme allows banks' customers to deposit their idle gold holdings for a fixed period in return for interest in the range of 2.25 percent to 2.50 percent.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

AIMIM News

Delhi Assembly polls: Owaisi leads Padyatra in Okhla

Feb 01, 2025

We reject this Waqf Amendment Bill: Asaduddin Owaisi

Jan 30, 2025

Latest Urdu News

Most Viewed

May 26, 2020

Which political party will win the Delhi Assembly polls to be held on Feb 5?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.