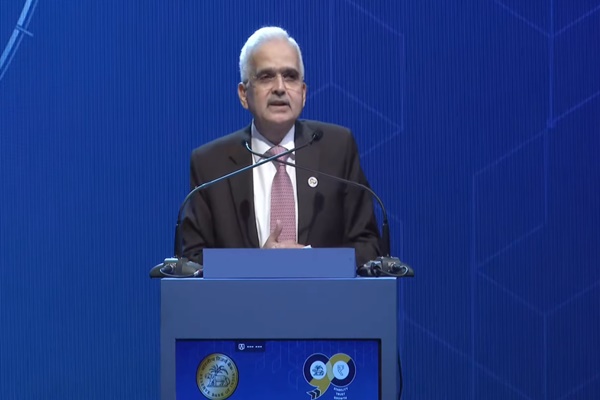

RBI Governor addresses Global Conference on DPI and Emerging Technologies in Bengaluru

Tue 27 Aug 2024, 10:51:29

Reserve Bank of India (RBI) Governor Shaktikanta Das has said that the new trinity of GEM, UPI, and ULI represents a revolutionary step forward in India’s digital payments.

He explained that the Unified Lending Interface (ULI) tech platform promoted by RBI will make frictionless credit possible in India.

RBI Governor addresses Global Conference on DPI and Emerging Technologies in Bengaluru.

He was speaking during the inaugural address at the Global Conference on Digital Public Infrastructure (DPI) and Emerging Technologies in Bengaluru, as part of RBI@90 initiative.

He noted that the current ecosystem of digital payments offers quick and safe transfers of funds, Das added.

He noted that the

Unified Payment Interface (UPI) launched by the National Payments Corporation of India (NPCI), has made monetary transactions easier.

Unified Payment Interface (UPI) launched by the National Payments Corporation of India (NPCI), has made monetary transactions easier.

Hence, RBI is now ready with a unified lending interface for frictionless credit.

ULI was launched as a pilot last year. He said this will be rolled out across the country soon.

The RBI governor explained that ULI cuts down time for credit appraisals for small borrowers. It is entirely consent-based and the data privacy is protected.

It will reduce the complexity of multiple tech integrations and play a similar role in transforming the lending ecosystem in India journey.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Do you think Canada-India relations will improve under New PM Mark Carney?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.