RBI keeps policy rate unchanged fourth time in a row

Fri 05 Feb 2021, 10:57:48

Mumbai: Reserve Bank of India (RBI) on Friday decided to leave benchmark interest rate unchanged at 4 per cent but maintained an accommodative stance, implying rate cuts in the future if need arises to support the economy hit by the COVID-19 pandemic.

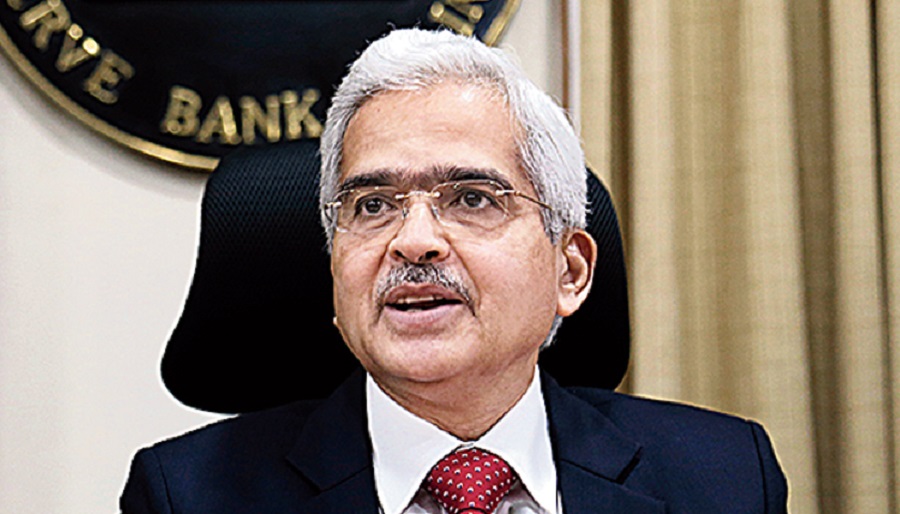

The benchmark repurchase (repo) rate has been left unchanged at 4 per cent, Governor Shaktikanta Das said while announcing the decisions taken by the central bank's Monetary Policy Committee (MPC).

Consequently, the reverse repo rate will also continue to earn 3.35 per cent for banks for their deposits kept with RBI.

He said MPC voted for keeping interest rate unchanged and decided to continue with its accommodative stance to support growth.

The central bank had slashed the repo rate by 115 basis points since late March 2020 to support growth.

This is the fourth time in a row that MPC has decided to keep the policy

rate unchanged. RBI had last revised its policy rate on May 22 in an off-policy cycle to perk up demand by cutting interest rate to a historic low.

rate unchanged. RBI had last revised its policy rate on May 22 in an off-policy cycle to perk up demand by cutting interest rate to a historic low.

The 27th meeting of the rate-setting MPC with three external members -- Ashima Goyal, Jayanth R Varma and Shashanka Bhide -- began on February 3. This is the first meeting of the rate setting panel after the Budget 2021-22, announced this week, projected a nominal GDP growth rate of 14.5 per cent and a fiscal deficit of 6.8 per cent for the financial year beginning April 1.

The government moved the interest rate setting role from the RBI Governor to the six-member MPC in 2016. Half of the panel, headed by the Governor, is made up of external independent members.

MPC has been given the mandate to maintain annual inflation at 4 per cent until March 31, 2021, with an upper tolerance of 6 per cent and a lower tolerance of 2 per cent.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

AIMIM News

Asaduddin Owaisi questions PM Modi's China policy

Jan 08, 2025

Owaisi slams UP over police post near Sambhal mosque

Dec 31, 2024

Owaisi hails SC order on Places of Worship Act

Dec 13, 2024

AAP Corporator Tahir Hussain joins AIMIM party

Dec 11, 2024

Latest Urdu News

Most Viewed

May 26, 2020

Which political party will win the Delhi Assembly polls to be held on Feb 5?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.