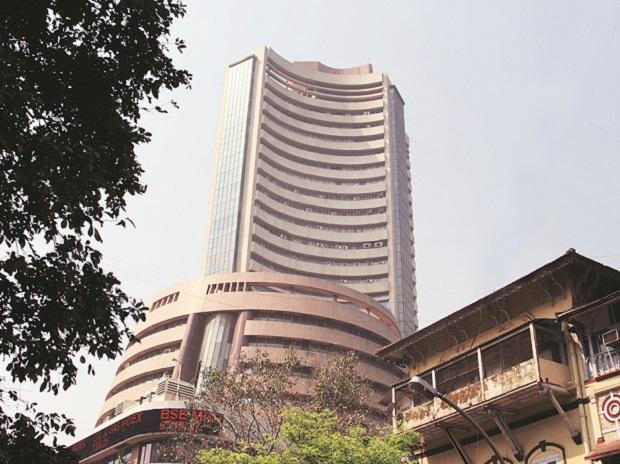

Sensex, Nifty hit record highs

Mon 13 Jan 2020, 11:56:10

Mumbai: Equity benchmarks Sensex and Nifty hit their record intra-day highs in early trade on Monday tracking gains in index-heavyweight Infosys amid positive domestic and global cues.

After rallying 293.69 pts to a record peak of 41,893.41, the 30-share BSE index was trading 248.57 points or 0.60 per cent higher at 41,848.29.

Similarly, the broader NSE Nifty scaled a high of 12,337.75, before trading 70.35 points or 0.57 per cent higher at 12,327.15.

Infosys was the top gainer, rising over 3 per cent, after the IT services major Infosys on Friday reported a 23.7 per cent rise in consolidated net profit at Rs 4,466 crore for the December quarter.

Sun Pharma, ITC, HCL Tech, Tata Steel, ICICI Bank and Kotak Bank were also trading on a positive note.

On the other hand, TCS, Maruti and HDFC were in the red.

In the previous session, Sensex ended 147.37 points, or 0.36 per cent, higher at 41,599.72 and the Nifty settled 40.90 points, or 0.33 per cent, higher at 12,256.80.

Meanwhile, on a net basis, foreign institutional investors bought equities worth Rs 578.28

crore, while domestic institutional investors purchased shares worth Rs 251.74 crore on Friday, data available with stock exchanges showed.

crore, while domestic institutional investors purchased shares worth Rs 251.74 crore on Friday, data available with stock exchanges showed.

According to traders, besides positive quarterly number from Infosys, positive domestic macro data, firm global cues and foreign fund inflow too boosted market mood here.

Having contracted for three months in a row, the Index of Industrial Production (IIP) recorded a growth of 1.8 per cent in November mainly on account of improvement in the manufacturing sector, said government data on Friday.

Investors are also awaiting inflation numbers to be released later in the day.

On the global front, with US-Iran tensions cooling off, market focus has shifted to the upcoming US-China trade deal signing, traders said.

Bourses in Hong Kong, Shanghai and Seoul were trading on a positive note in their early sessions.

Brent crude futures slipped 0.09 per cent to USD 64.92 per barrel.

Meanwhile, the rupee appreciated 8 paise to 70.85 against the US dollar in morning session.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

AIMIM News

Asaduddin Owaisi questions PM Modi's China policy

Jan 08, 2025

Owaisi slams UP over police post near Sambhal mosque

Dec 31, 2024

Owaisi hails SC order on Places of Worship Act

Dec 13, 2024

AAP Corporator Tahir Hussain joins AIMIM party

Dec 11, 2024

Latest Urdu News

Most Viewed

May 26, 2020

Which political party will win the Delhi Assembly polls to be held on Feb 5?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.