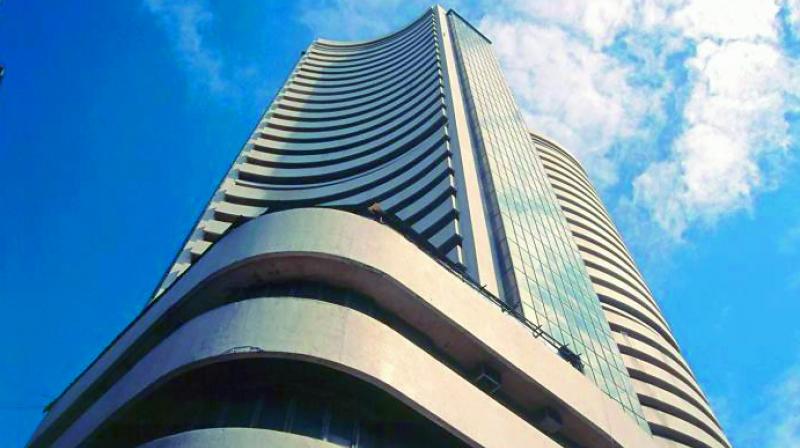

Sensex plunges over 400 points in early trade

Fri 23 Mar 2018, 10:46:57

Domestic equities took a beating today amid a global selloff after US President Donald Trump imposed USD 60 billion tariffs on Chinese imports -- a move that has fuelled concerns of a international trade war.

The BSE Sensex fell below the 33,000-level, plummeting 471.44 points, or 1.42 per cent, to 32,534.83. The gauge had lost 129.91 points in the previous session.

The NSE Nifty too cracked below the crucial 10,000 mark by diving 153.45 points, or 1.51 per cent, to 9,961.30.

All the sectoral indices, led by metal, realty, banking and capital goods stocks, were trading in the red, falling up to 2.77 per cent.Top laggards were Yes Bank, Tata Steel, ICICI Bank, SBI, Bajaj Auto, Axis Bank, Tata Motors, Hero MotoCorp and L&T, falling by up to 3.08 per

cent.

cent.

Investor sentiment turned extremely bearish, in line with sharp losses on the Wall Street and Asian markets, on growing fears of a global trade war after Donald Trump imposed tariffs on Chinese imports and Beijing drawing up a list of retaliatory measures, brokers said.

Meanwhile, foreign portfolio investors (FPIs) continued selling on domestic bourses. On a net basis, they sold shares worth Rs 1,065.99 crore, while domestic institutional investors (DIIs) made purchases to the tune of Rs 1,127.78 crore on Friday, provisional data showed.

In Asia, Japan's Nikkei fell 3.54 per cent, Hong Kong's Hang Seng down 2.78 per cent in early deals. The Shanghai Composite index dropped by 3.06 per cent.

The US Dow Jones Industrial Average ended 2.93 per cent lower yesterday.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Do you think Canada-India relations will improve under New PM Mark Carney?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.