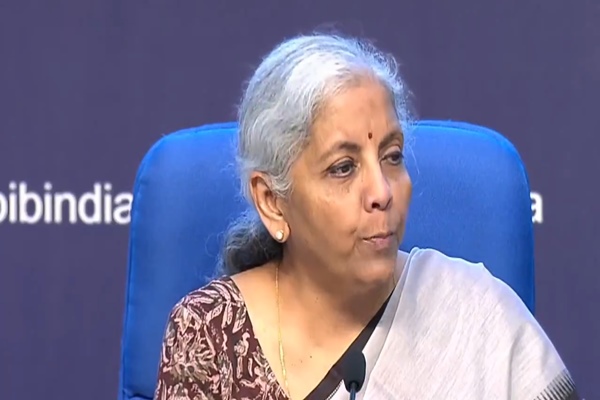

Standard Deduction For Salaried Employees Increased To Rs 75,000 Under New Tax Regime

Wed 24 Jul 2024, 10:35:17

Finance Minister has increased the standard deduction for salaried employees in Income Tax from 50,000 rupees to 75,000 rupees under the new tax regime. Similarly, the deduction on family pension for pensioners is enhanced from 15,000 rupees to 25,000 rupees. This will provide relief to about four crore salaried individuals and pensioners.

The government has also revised the tax rate structure for those opting for the new tax regime.

As a result of these changes, a salaried employee in the new tax regime stands to save up to 17,500 rupees in income tax. The government has increased the deduction of expenditure by employers towards the New Pension Scheme (NPS) from 10 to 14 per cent of the employee’s salary.

The Finance Minister has reduced the corporate tax rate on foreign companies from 40 to 35 per cent to attract foreign capital for our development

needs. The government has abolished the so-called angel tax for all classes of investors to bolster the Indian start-up eco-system and boost the entrepreneurial spirit.

needs. The government has abolished the so-called angel tax for all classes of investors to bolster the Indian start-up eco-system and boost the entrepreneurial spirit.

Vivad Se Vishwas Scheme, 2024 has been proposed for the resolution of certain income tax disputes pending in appeal.

The government has simplified capital gains taxation. Short-term gains on certain financial assets shall henceforth attract a tax rate of 20 per cent. Long-term gains on all financial and non-financial assets, on the other hand, will attract a tax rate of 12.5 per cent. Mrs. Sitharaman has increased the limit of exemption of capital gains on certain financial assets to 1.25 lakh rupees per annum for the benefit of lower and middle-income classes.

The government has announced a comprehensive review of the Income-tax Act, 1961.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Do you think Canada-India relations will improve under New PM Mark Carney?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.