Wide acceptance in G20 FMCBG meeting that Crypto Assets are major risks to financial stability, says RBI governor

Mon 27 Feb 2023, 10:18:54

Mumbai: In the first major ministerial engagement under G20, where, India welcomed the debate on Crypto Assets proposing regulations and a policy perspective on the use of Crypto Assets.

Participating members of the G20 Finance Ministers and Central Bank Governors (FMCBG) in the outcome document, on the conclusion of the meeting on Saturday, also welcomed that crypto-assets are being closely monitored and subject to robust regulation to mitigate potential risks to financial stability.

Briefing media on conclusion of the meeting, Finance Minister Nirmala Sitharaman said that there is almost a clear understanding that anything not backed by the central bank is not currency and this is the position

that India has been taking for a very long time.

that India has been taking for a very long time.

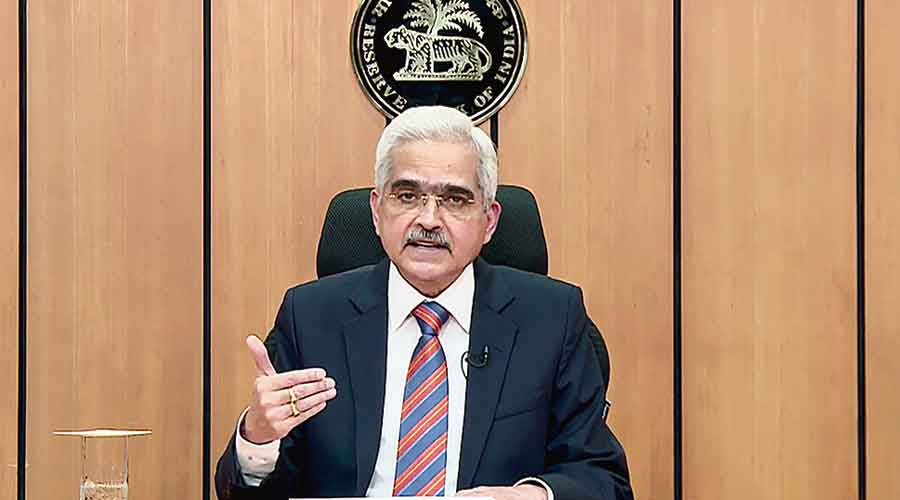

Meanwhile, Reserve Bank of India (RBI) governor Shaktikanta Das told the media that there is now wide recognition and acceptance of the fact that Crypto-currencies or Assets are major risks to financial stability, monetary systems and cyber security.

He said, during the FMCBG meeting delegates took interest in the central bank digital currency (CBDC) pilot projects in some countries, including India.

Crypto currency is a digital currency in which transactions are verified and records maintained by a decentralized system using cryptography, instead of a centralized authority.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Do you think Canada-India relations will improve under New PM Mark Carney?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.