Arun Jaitley held regulators and auditors responsible for the 11,400-crore fraud at PNB

Sat 24 Feb 2018, 16:35:53

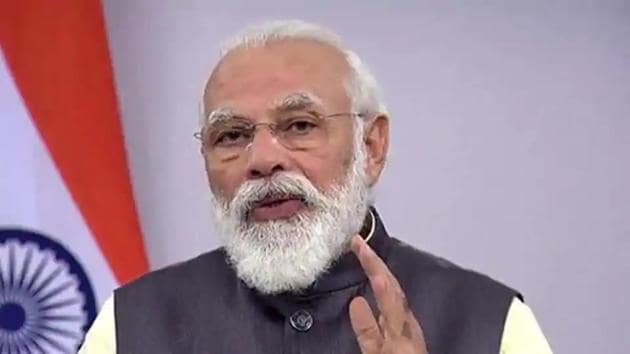

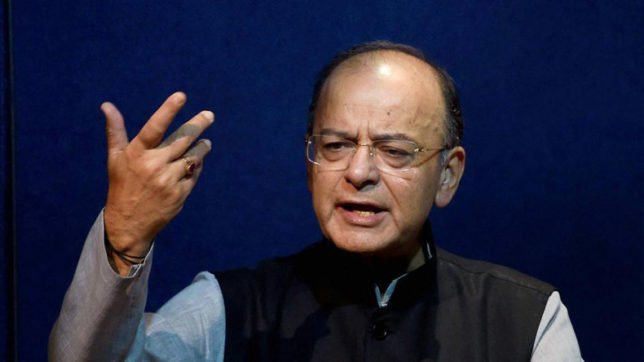

Finance minister Arun Jaitley on Saturday held regulators and auditors responsible for the 11,400-crore fraud at Punjab National Bank, India’s second-biggest state-owned lender, and said there is a need to tighten laws to punish fraudsters.

Speaking at the Global Business Summit, Jaitley said, “Regulators have a very important function. They ultimately decide the rules of the game and have to have a third-eye which is to be perpetually be open. But unfortunately in the Indian system, we politicians are accountable, the regulators are not.”

He added, “The law would be tightened further, if necessary, in order to find out where they (fraudsters) are and what is the extreme action that law permits against such delinquent persons.”

The finance minister called it worrisome that loan frauds went undetected in the banking sector and a single flag was not raised when the fraud was detected. “Also, worrisome is top management who were indifferent to what was going on or were unaware of what was going on. There were at least multiple layers of auditing system which chose to either look the other way or do a casual job. You had inadequate supervision,” he said. “Therefore, I think who did what, will eventually find out in the course of the

investigation,” he added.

investigation,” he added.

Jaitley said periodic surfacing of bank frauds made it difficult to do business in India while the scars on the economy take front seat. On mounting NPAs or bad debts, he asked how much of them are due to business failure and how much because of diversions by companies. “Cases of wilful defaults are something which is much more than the business failure itself,” he said.

This apart, the minister also spoke on the need to develop a habit of doing ethical business. “Those who deviate from that cause must always remember that the consequences will not only be commercial and civil. I think when I speak in terms of ethical practices, I think it is a significant problem in India,” he said, adding that Indian businesses should also look inward rather just ask what the governments are doing.

Nirav Modi, whose diamond creations have draped Hollywood stars such as Kate Winslet and Dakota Johnson, his uncle Mehul Choksi and firms linked to them are alleged to have acquired fraudulent letters of undertaking (LoUs) from one PNB branch in Mumbai between 2011 and 2017 to obtain loans from Indian banks overseas for which they were ineligible. Investigative agencies have raided their properties and arrested bank employees and persons linked to his firms.

No Comments For This Post, Be first to write a Comment.

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Which Cricket team will win the IPL 2025 trophy?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.