Atal Pension Yojana: Invest Rs 210 per month to get Rs 5,000 monthly pension

Fri 03 Sep 2021, 14:35:53

New Delhi: Atal Pension Yojana (APY) is a pension scheme run by the government of India and is operated by the pension fund regulator Pension Fund Regulatory and Development Authority (PFRDA). For people looking to invest for a fixed pension during their retirement, APY is an attractive option. The pension scheme was launched by the government to provide income security in old age to people in the unorganized sector.

Any Indian citizen, who has a bank account and works in the unorganised sector, in the age group of 18-40 years can invest in the Atal Pension Yojana scheme. The Central government manages the Atal Pension Yojana via the National Pension Scheme (NPS) architecture.

Investors who have invested in the Atat Pension Yojana will start receiving the benefits at the time of retirement at the age of 60 years, which means that investors will have to invest for a minimum of 40 years in the scheme.

Investors receive monthly pensions until their death in the Atal Pension Yojana. In case

of the death of the investor, the spouse continues to receive pension till his or her death. In the event of the death of the investor and the spouse, the entire corpus is transferred into the account of the nominee.

of the death of the investor, the spouse continues to receive pension till his or her death. In the event of the death of the investor and the spouse, the entire corpus is transferred into the account of the nominee.

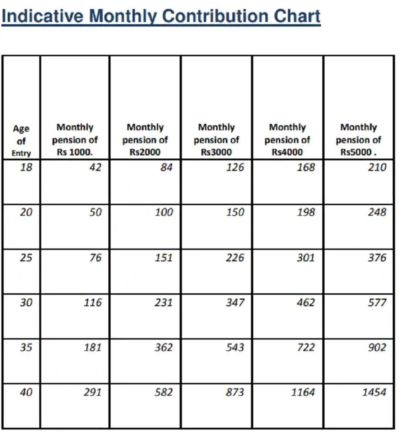

How to get a Rs 5000 monthly pension by investing just Rs 210 per month?

This monthly pension keeps on increasing if the account holder is late in opening APY account. This means, it's better to open APY account at the age of 18 as it gives maximum 42 years for contribution leading to least monthly contribution. APY account holder will have to pay more monthly contribution if its age is more than 18 years. As per the APY chart, an individual who is 30 year old, its monthly contribution for Rs 1000 pension is Rs 116. This monthly contribution will shot up to Rs 577, if the APY account holder chooses Rs 5000 monthly pension.

So, if a person opens APY account at the age of 18, he or she can fetch Rs 5000 monthly pension on its Rs 210 monthly savings.

No Comments For This Post, Be first to write a Comment.

Most viewed from General

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Do you think Canada-India relations will improve under New PM Mark Carney?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)