Lost PAN Card? Here's How you can Download Instant e-PAN in 10 Minutes

Sun 04 Jul 2021, 14:30:08

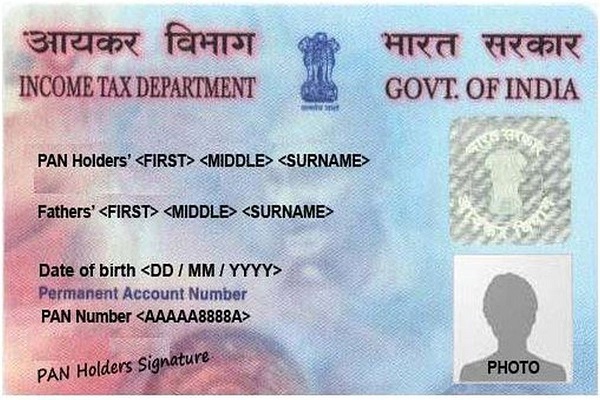

A Permanent Account Number (PAN) card is one of the essential financial documents. It not only helps a person in filing their income tax return but also facilitates KYC. Without a PAN card, access to many day-to-day services such as opening a bank account, transacting money above a defined amount, obtaining a credit or debit card among others can become impossible.

However, in case you ever lose or misplace your PAN card, the income tax department has an online facility of e-PAN using which you can immediately download a digital version of your PAN card, which is equally valid in all the places you use your PAN. The download does not require you to remember your PAN number and just uses your Aadhar number.

The e-PAN can be downloaded from the official website of the Income Tax Department by following a few simple steps:

1. Go to the official website of Income Tax e-Filing - https://www.incometax.gov.in/

2. Under the lower-left section of “Our Services” look for Instant E-PAN. It should be just below “Know TAN…”

Here is a direct link -

https://eportal.incometax.gov.in/iec/foservices/#/pre-login/instant-e-pan

https://eportal.incometax.gov.in/iec/foservices/#/pre-login/instant-e-pan

3. If you have never downloaded e-PAN before, click on Continue under the “Get New e-PAN section”

4. If you have downloaded e-PAN before, click under the “Check Status/Download PAN” section, click on Continue.

5. Now, the website will ask for your Aadhar number. Enter your 12-digit Aadhaar number in the input field

Read carefully the declaration and if you agree, check it and click continue

6. You will receive an OTP on your Aadhaar-linked mobile number. Enter the OTP in the given field.

7. Check your information carefully, and enter your email address in the specified field, and click on confirm button.

8. Soon, you will receive your e-PAN in your email inbox. Check your email inbox and get the PAN printed if you want.

However, If you have your PAN number and for some reason, you are not able to download it using the above method, you can also download it from the website of TIN-NSDL or UTIITSL websites depending on where your original PAN card was generated.

No Comments For This Post, Be first to write a Comment.

Most viewed from General

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Do you think Canada-India relations will improve under New PM Mark Carney?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)