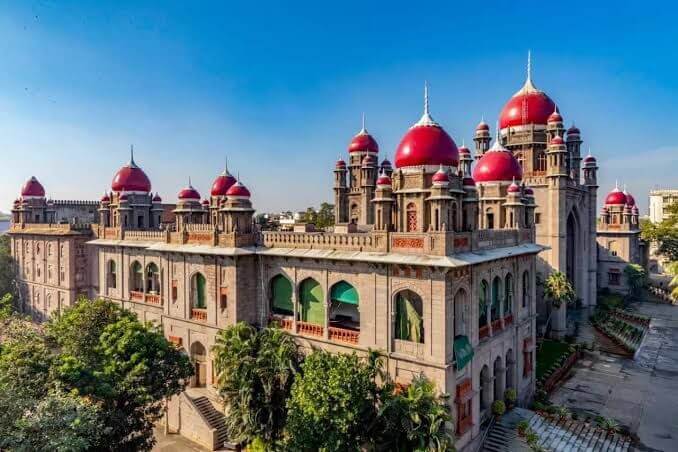

CAG pulls up Telangana Government for irregular accounting procedure

Fri 30 Mar 2018, 10:55:41

The Comptroller and Auditor General (CAG) pulled up Telangana government for its irregular accounting procedure and poor maintenance of the state’s finances.

The CAG also indicted the government for not regularising excess expenditure in the report for the year ended March 2017, which it submitted to the Telangana Assembly on Thursday.

The CAG analysed Telangana finances in which the state registered revenue surplus of Rs 1,386 crore during 2016-17. The audit report disclosed that the revenue surplus was overstated by Rs 6,778 crore on account of irregular accounting. Thus, the state had revenue deficit of Rs 5,392 cr. Fiscal deficit (Rs 35,281 cr) which stood at 5.46 per cent of the GSDP (Gross State Domestic Product) was understated by Rs 2,500 cr due to crediting of borrowed funds as revenue receipts.

The independent accounting authority observed the ratio of fiscal deficit to GSDP excluding amount transferred under Ujwal Discom Assurance Yojana (UDAY) (Rs 7,500 cr) was 4.3 per cent.“This exceeded the ceiling of 3.5 per cent stipulated for 2016-17 by the 14th Finance Commission and targeted in the Medium Term Fiscal Policy Statement (MFPS) of the state under Fiscal Responsibility and Budget Management (FRBM)Act.

The CAG also questioned the state government for not releasing all money borrowed through UDAY bonds to the

Discoms.Under the Uday scheme, government borrowed Rs 8,931 cr and released Rs 7,500 cr only. The entire amount transferred to the Discoms has been booked under capital expenditure as equity.

Discoms.Under the Uday scheme, government borrowed Rs 8,931 cr and released Rs 7,500 cr only. The entire amount transferred to the Discoms has been booked under capital expenditure as equity.

The authority observed booking of Rs 3,750 cr (50 per cent of Rs 7,500 cr released to Discoms) as equity instead of grant resulted in overstatement of revenue surplus to that extent. It also found financial institutions had not issued any new bonds as stipulated in the UDAY scheme for the remaining balance loans of Discoms.

The CAG charged the government with excess expenditure over the allocations amounting Rs 6,184 cr pertaining to the years 2014-15 and 2015-16 and its failure in regularising till 2017 December. It observed “the cases of excess expenditure over grants are serious breaches and are in violation of the wish of the legislature”.

Paying interest at higher rates (7.40 per cent) on borrowings while keeping huge amount in PD (Personal Deposit) accounts was a glaring example of poor cash and financial management of the state government, the CAG said and found the incidence of non re-conciliation was 67 per cent (Rs 73,783 cr) of total expenditure and 77 per cent (Rs 55,116 cr) of total receipts”. “It will lead to the risk of non-detection of leakages in revenue and irregularities in expenditure”, the report said.

No Comments For This Post, Be first to write a Comment.

Most viewed from Hyderabad

Most viewed from World

AIMIM News

Delhi Assembly polls: Owaisi leads Padyatra in Okhla

Feb 01, 2025

We reject this Waqf Amendment Bill: Asaduddin Owaisi

Jan 30, 2025

Latest Urdu News

Most Viewed

May 26, 2020

Which political party will win the Delhi Assembly polls to be held on Feb 5?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)