Centre allows TS govt to raise additional Rs 9,000 cr loans

Sat 13 Jan 2024, 11:15:56

The Centre on Friday permitted the state government to raise an additional Rs 9,000 crore through the auction of bonds in the last quarter of this financial year (January-March 2023-24) after the BRS government had exhausted the annual quota before the Assembly elections.

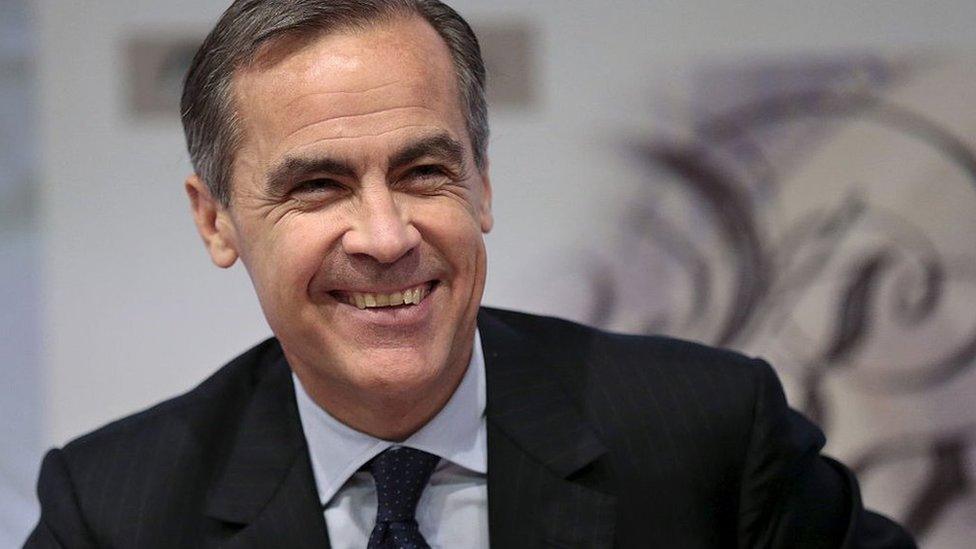

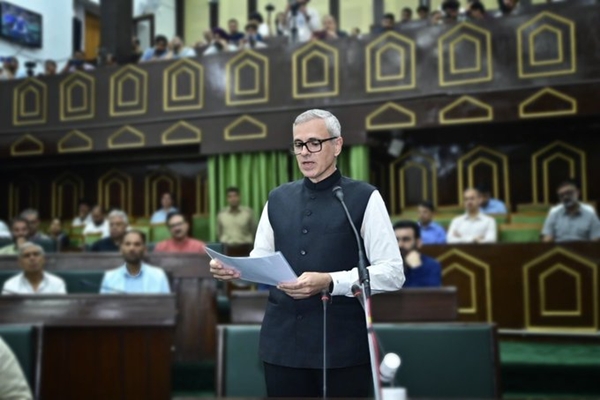

The approval came two weeks after Chief Minister A. Revanth Reddy met Prime Minister Narendra Modi and Union Finance Minister Nirmala Sitharaman in Delhi on December 26 and requested them to allow the state government to raise an additional Rs 13,000 crore through loans.

The CM brought to their notice that the previous BRS government had availed of the entire loan limit for 2023-24 and the Congress government which took over on December 7 was facing a fund crunch with no scope to raise loans for the remaining three months of this fiscal.

Revanth Reddy complained that the BRS government had pushed Telangana state into a debt trap with its financial mismanagement and urged them to sanction additional loans.

The Centre gave the nod to raise Rs 9,000 crore against the Rs 13,000 crore sought by the state government. Following this, the Reserve Bank of India issued a notification on Friday

allowing the state government to participate in the auction of bonds to raise Rs 2,000 crore on January 16.

allowing the state government to participate in the auction of bonds to raise Rs 2,000 crore on January 16.

As per the loan limit norms under the Financial Responsibility and Budget Management (FRBM) Act, the Telangana state government was eligible to raise Rs 57,813 crore through the auction of bonds for 2023-23. The Centre slashed this to Rs 42,225 crore after taking into account the off-budget borrowings via state-run corporations.

The BRS government exceeded this revised limit, borrowing Rs 38,151 crore till October end as against the Rs 38,234 crore borrowing projected for the full financial year in the Budget estimates.

The BRS government raised another Rs 4,400 crore in November and December taking the total borrowings to Rs 42,551 crore, Rs 300 crore higher than the limit fixed by the Centre.

The state government is facing a fund crunch to disburse the Rythu Bandhu amount to farmers for the ongoing rabi season and also for the implementation of welfare schemes and programmes. The additional Rs 9,000 crore loans would help the state government to overcome the financial crisis to some extent.

No Comments For This Post, Be first to write a Comment.

Most viewed from Hyderabad

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Which Cricket team will win the IPL 2025 trophy?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)