GHMC Makes Property Tax Payment Easy

Sat 01 Jun 2024, 11:56:49

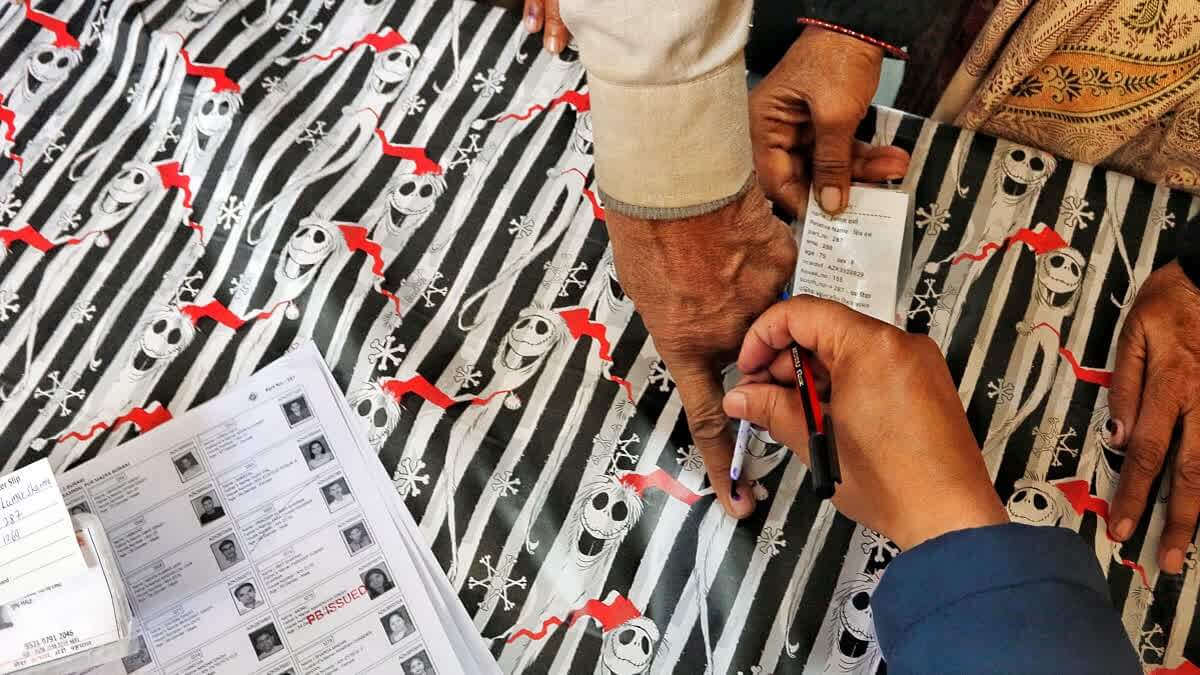

With an aim to collect Rs 2,200 crore in property tax in the current financial year, the GHMC served notice to eight lakh owners — for the first time — through text messages with a link to the payment gateway to pay up their tax. Out of these eight lakh people, around three lakh are defaulters, and GHMC would begin enforcement activity, including sealing of premises, within a week. Previously, the property tax notice — also called property tax demand bill — was issued by bill collectors physically. The tax was paid either to bill collectors or at GHMC citizen service centres in cash or digitally on the GHMC website or mobile app.

“Earlier, the payment gateway was not available in the text messages that we sent to property owners. It has been introduced by GHMC commissioner Ronald Rose,” said a GHMC official. In the SMS sent, as soon as the person clicks the link, the entire tax details with his property tax identification number (PTIN) number are displayed with the payment gateway. This will make the

payment of tax easy for the property owners who would have to just click on the link and complete the payment process.

payment of tax easy for the property owners who would have to just click on the link and complete the payment process.

For those properties whose owners’ mobile numbers were not available in the GHMC database, the bill collectors will visit their houses and hand them the property tax demand bill as a hard copy. "All the phone numbers of property owners will be registered soon with the corporation," said an official. The GHMC has also decided against waiting till the end of the financial year to seek the owners to clear property tax arrears.

“This week we will start issuing warrants, and the properties of the defaulters will be sealed,” said another senior official from the corporation. “We have already sealed over 200 buildings this year for not paying property tax and the enforcement activity will again start this week,” he added. However, the GHMC’s attachment will not be reflected in the encumbrance certificate.

No Comments For This Post, Be first to write a Comment.

Most viewed from Hyderabad

Most viewed from World

AIMIM News

Delhi Assembly polls: Owaisi leads Padyatra in Okhla

Feb 01, 2025

We reject this Waqf Amendment Bill: Asaduddin Owaisi

Jan 30, 2025

Latest Urdu News

Most Viewed

May 26, 2020

Which team will win the ICC Men's Champions Trophy 2025 held in Pakistan/Dubai?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)