Survey says, Hyderabad witnesses lowest term insurance adoption:

Wed 16 Mar 2022, 07:58:21

Despite Hyderabad’s term insurance awareness of 79 per cent, the city has witnessed the lowest term insurance adoption. Even amidst the pandemic, only 41 per cent or 2 in 5 persons in Hyderabad owned term insurance.

This was surpassed by Bengaluru with 59 per cent term insurance ownership, Mumbai with 50 per cent, Chennai with 48 per cent and Delhi registering 47 per cent ownership, said India Protection Quotient 4.0 survey by Max Life Insurance and consulting company Kantar.

“The survey highlights the milestones as well as challenges for the insurance industry. Hyderabad has a long road ahead in terms of proactive financial planning, life insurance awareness and ownership. There is a need to bridge this gap for Hyderabad, encouraging the city to realise the role of life

insurance in financially protecting our loved ones,” said V Viswanand, Max Life Deputy Managing Director.

insurance in financially protecting our loved ones,” said V Viswanand, Max Life Deputy Managing Director.

Hyderabad is the most financially anxious city followed by Kolkata, Mumbai and Chennai. About 72 per cent respondents reported financing children’s education as a major stress followed by sustaining lifestyle and expenses with current earnings (68 per cent), financing children’s wedding (66 per cent) and worries over mental health and well-being (65 per cent), it further said.

Only 70 per cent respondents were proactive about financial planning in Hyderabad as compared to 83 per cent in Mumbai, 79 per cent in Bengaluru, Kolkata and 77 per cent in Delhi. About 72 per cent respondents were conscious of their personal wellbeing and maintaining a routine fitness regime, the survey said.

No Comments For This Post, Be first to write a Comment.

Most viewed from Hyderabad

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

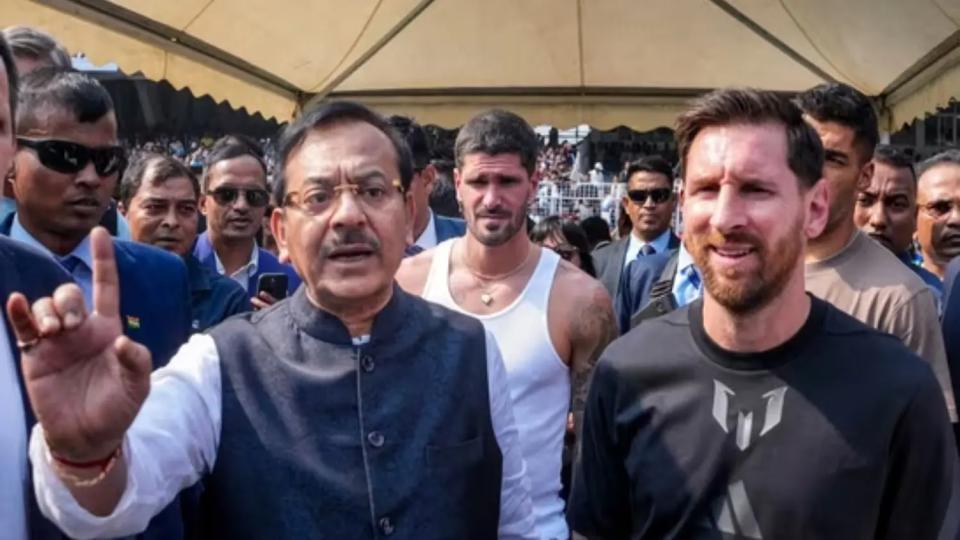

Can Lionel Messi's visit boost Indian football?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)