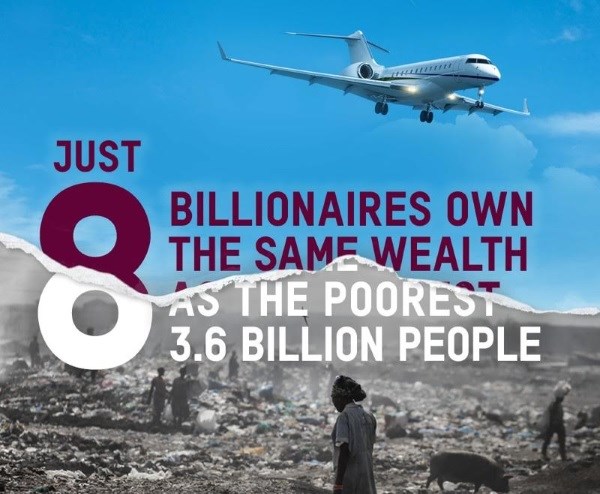

Eight men own same wealth as half the world; one in 10 people live on less than $2 a day

Mon 16 Jan 2017, 14:23:12

A new report has highlighted that the eight richest people in the world own the same wealth as 3.6 billion people who make up the poorer half of the world’s population, writes Denise O'Donoghue.

The report was published today by Oxfam ahead of a meeting of political and business leaders at the World Economic Forum in Davos, Switzerland this week.

The report was published today by Oxfam ahead of a meeting of political and business leaders at the World Economic Forum in Davos, Switzerland this week.

An Economy for the 99 Percent shows that the gap between rich and poor is far greater than had been thought thanks to new and better data on global wealth.

The world could also see its first trillionaire in just 25 years. To spend a trillion euro, someone would have to spend over €1 million a day for 2,738 years.

The world could also see its first trillionaire in just 25 years. To spend a trillion euro, someone would have to spend over €1 million a day for 2,738 years.

Since 2015, the richest one percent has owned more wealth than the other 99 percent combined.

The report also details how governments are facilitating big corporations and the super-rich to dodge taxes and use their power to influence politics – which is fuelling the inequality crisis.

"It is obscene for so much wealth to be held in the hands of just eight men – so few they would fit on a golf buggy – when one in nine people on this planet go to bed hungry every night," says Jim Clarken, Oxfam Ireland Chief Executive.

"Public anger is already creating political shockwaves across the globe with inequality cited as a significant factor in the election of Donald Trump in the US and Brexit in the UK.

"People are tired of a system which seems rigged against them, where big business and the super-rich use their money and connections to ensure government policy works for them.

"It is obscene for so much wealth to be held in the hands of just eight men – so few they would fit on a golf buggy – when one in nine people on this planet go to bed hungry every night," says Jim Clarken, Oxfam Ireland Chief Executive.

"Public anger is already creating political shockwaves across the globe with inequality cited as a significant factor in the election of Donald Trump in the US and Brexit in the UK.

"People are tired of a system which seems rigged against them, where big business and the super-rich use their money and connections to ensure government policy works for them.

"A fundamental change in the way we manage our economies is required so they benefit everyone, not just a fortunate few. We need a global economy for the 99 percent, not just the one percent."

The report highlights how large-scale tax dodging by corporations and wealthy individuals is contributing to inequality with the poorest losing out, as they are most reliant on the public services this forgone revenue could provide.

Kenya is losing $1.1bn every year in tax exemptions for corporations, nearly twice its budget for health, in a country where women have a one in 40 chance of dying in childbirth.

"Tax revenues are critical for funding the policies and services that can fight inequality including infrastructure, health and education," Clarken says.

"The use of tax havens and loopholes or the securing of preferential tax

treatment doesn’t just reduce abstract balance sheets. Everyone else is forced to pick up the bill and the human cost is borne by the most vulnerable in society."

Kenya is losing $1.1bn every year in tax exemptions for corporations, nearly twice its budget for health, in a country where women have a one in 40 chance of dying in childbirth.

"Tax revenues are critical for funding the policies and services that can fight inequality including infrastructure, health and education," Clarken says.

"The use of tax havens and loopholes or the securing of preferential tax

treatment doesn’t just reduce abstract balance sheets. Everyone else is forced to pick up the bill and the human cost is borne by the most vulnerable in society."

Oxfam Ireland is urging the Irish Government to introduce new mechanisms to increase tax transparency and stop tax dodging by multinational corporations that negatively affects poorer countries.

"The Irish Government has made efforts to reform the tax system especially in relation to tax dodging by wealthy individuals. We need to tackle aggressive tax planning by corporations, to implement strong controlled foreign company rules to prevent profit-shifting and improve transparency by forcing multinationals to make public where they make profits and pay tax.

"Ireland needs to continue supporting international tax transparency and should back a proposal to create a global tax body to oversee necessary reform."

Oxfam Ireland is also asking that commitments made in the Programme for Government to ‘develop the process of budget and policy proofing as a means of advancing equality’ be put into action.

Oxfam Ireland is also asking that commitments made in the Programme for Government to ‘develop the process of budget and policy proofing as a means of advancing equality’ be put into action.

"Inequality is not inevitable. World leaders can rebalance economies with every budget passed and every rule of law or regulation written or dismantled."

Oxfam’s report lays out a blueprint for a more human global economy, which includes greater cooperation between governments on tax dodging to generate the funds needed to invest in healthcare, education and job creation, and by dismantling the barriers to women’s economic progress such as access to education and the unfair burden of unpaid care work. On current trends it will take 170 years for women to be paid the same as men.

1. Bill Gates: America founder of Microsoft (net worth $75 billion)

2. Amancio Ortega: Spanish founder of Inditex which owns the Zara fashion chain (net worth $67 billion)

3. Warren Buffett: American CEO and largest shareholder in Berkshire Hathaway (net worth $60.8 billion)

4. Carlos Slim Helu: Mexican owner of Grupo Carso (net worth: $50 billion)

5. Jeff Bezos: American founder, chairman and chief executive of Amazon (net worth: $45.2 billion)

6. Mark Zuckerberg: American chairman, chief executive officer, and co-founder of Facebook (net worth $44.6 billion)

7. Larry Ellison: American co-founder and CEO of Oracle (net worth $43.6 billion)

8. Michael Bloomberg: American founder, owner and CEO of Bloomberg LP (net worth: $40 billion)

1. Bill Gates: America founder of Microsoft (net worth $75 billion)

2. Amancio Ortega: Spanish founder of Inditex which owns the Zara fashion chain (net worth $67 billion)

3. Warren Buffett: American CEO and largest shareholder in Berkshire Hathaway (net worth $60.8 billion)

4. Carlos Slim Helu: Mexican owner of Grupo Carso (net worth: $50 billion)

5. Jeff Bezos: American founder, chairman and chief executive of Amazon (net worth: $45.2 billion)

6. Mark Zuckerberg: American chairman, chief executive officer, and co-founder of Facebook (net worth $44.6 billion)

7. Larry Ellison: American co-founder and CEO of Oracle (net worth $43.6 billion)

8. Michael Bloomberg: American founder, owner and CEO of Bloomberg LP (net worth: $40 billion)

No Comments For This Post, Be first to write a Comment.

Most viewed from International

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Do you think Canada-India relations will improve under New PM Mark Carney?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)