Inflationary situation in Kingdom ‘decoupling from global trend’

Sun 27 Nov 2016, 09:44:47

JEDDAH: The inflationary situation in Saudi Arabia is decoupling from the global trend following a series of fiscal consolidation measures, according to economists.

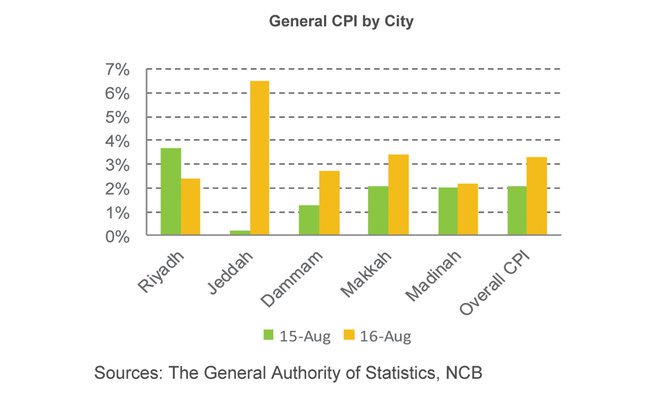

After averaging 2.7 percent in 2014 and 2.2 percent in the following year, inflation almost doubled during the first eight months of 2016, averaging around 4 percent, the National Commercial Bank said in a recent report.

As the budget deficit soared, the government reduced the blanket subsidy which was estimated to burden the government with over SR400 billion a year. About 60 percent of the utility subsidies went to benefit businesses and encouraged overspending of such valuable resources.

The slab tariff system introduced in January this year will lead to more responsible consumption and lessen the financial burden on the government, NCB’s economists added.

During the first eight months of 2016, the housing and utility category surged by an average of 7.7 percent year-on-year due to the hike in water and electricity bills.

The surge of water supply bills averaged around 200 percent year-on-year whereas electricity bills upturned by 14.3 percent.

The reduction of retail gasoline subsidies also hiked the prices by an average of 60.8 percent Y/ Y. The trickle-down effect can be noticed in various sectors in the economy as expenditure groups such as transport services experienced an average increase in prices by 11.2 percent Y/Y, while hospital services surged by 13.6 percent Y/Y.

By Region, the surge in energy and utility prices in 2016 varied considerably. The general cost of living index record- ed the highest average increase in Baha at 7.6 percent Y/Y, followed by Jeddah at 6.3 percent Y/Y. The lowest average annualized inflation during this year was seen in Hail at 2.6 percent, followed by Madinah at 2.8 percent. The response from the government subsidy reduction has also been uneven among cities.

In Riyadh, for instance,

the prices of water supply and related services quadrupled, surging by 349.2 percent Y/Y in the months leading to August.

the prices of water supply and related services quadrupled, surging by 349.2 percent Y/Y in the months leading to August.

Jeddah city recorded an average increase of 116.2 percent Y/Y in water bills, whereas in Dammam the impact was considerably less, marking an average increase of 54.3 percent Y/Y.

In an opposite trend, the prices of housing rentals have cooled off relative to last year as the residential property market reform stuttered investors and lenders.

Inflation in housing rentals averaged 3.5 percent in the months leading to August compared to 4.1 percent over the same period last year.

In the main municipalities, Jeddah recorded the highest annualized surge of 18.5 percent, whereas Riyadh and Dammam inched up by 1.5 percent and 1.3 percent, respectively.

The report said that global inflation remains at a seven- year low despite prolonged easy monetary policy by the core economies’ central banks, .

According to the Organization for Economic Co- operation and Development (OECD), the annual rate of inflation for the group of countries that produce about 85 percent of the world’s output, also known as the G20, inched down to 2.1 percent Y/Y in August. Persistently low inflation is pressuring respective central banks at the EU, UK, Japan and the EM to continue monetary easing measures while preventing the US Federal Reserve from normalizing its monetary policy.

Numerous surprise key interest rate cuts took place in 2016 in order to stimulate growth while currency carry trade allowed commodity currencies to depreciate.

In addition, recurrent expectations of a Federal rate hike in the US is pressuring commodities, notably energy, metals and food grains. In regards to energy prices, the oil supply glut exacerbated the slide which started in the second half of 2014.

As a vital factor in production, cheap energy prices trickled down to almost every category in the consumer basket.

No Comments For This Post, Be first to write a Comment.

Most viewed from International

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Do you think Canada-India relations will improve under New PM Mark Carney?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)