Middle East travel growth anaemic says report

Fri 23 Nov 2018, 23:41:11

Middle East region experienced anaemic travel growth during the first 10 months of the year, according to research by ForwardKeys, which analyses over 17 million flight booking transactions a day.

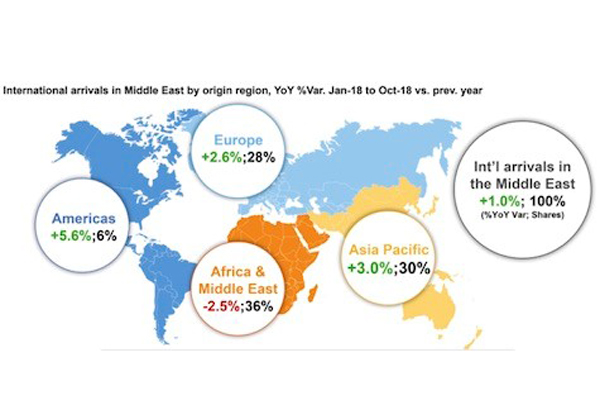

International arrivals grew just 1 per cent in the period January 18 to October 18, compared with the equivalent period last year.

The report was released during the annual Middle East & Africa Duty Free Association (MEADFA) conference taking place in Beirut.

Arrivals from the Americas, Asia Pacific and Europe grew by 5.6%; 3%; and 2.6%, respectively but they fell 2.5% from Africa and the Middle East.

Within the Middle East, the UAE is the most important destination by far, attracting nearly half of all air traffic. It was up 2% but the next two most important destinations, Saudi Arabia and Qatar were down 2% and 7%, respectively.

Dubai, the world’s busiest airport, has continued to grow its share of the ‘transfer’ market, to the detriment of Abu Dhabi as well as Qatar, and it has been successful in continuing to attract visitors who stay overnight in the destination too. The airport which competes with Dubai most successfully is Istanbul. By visitor arrivals, it is around two thirds the size of Dubai but it has seen a 31% surge

in visitors staying overnight, as concerns about security, dating back to an attack on the airport in 2016, have receded.

in visitors staying overnight, as concerns about security, dating back to an attack on the airport in 2016, have receded.

Looking into the future, bookings for the Middle East in the next two months (Nov 18 – Jan 10) are 2.4% behind where they were at the same point last year. The cause of this slowdown is bookings from the Asia Pacific, which are 11.1% behind where they were at the equivalent point last year. By contrast, forward bookings from the Americas, Europe and Africa & the Middle East are all ahead, by 3.1%, 1.0% and 4.3%, respectively.

The Asia Pacific setback is due particularly to Pakistan, from where bookings are 35.4% behind. Bookings from Australia are 19.1% behind and from Indonesia, 11.8% behind.

From mid-April to the end of May next year, Dubai will close one of its runways for upgrade work. This has prompted airlines to cut their seat capacity by 22% during the period. By contrast, airlines are planning to increase capacity to Doha and Istanbul but decrease it to Abu Dhabi, the report said.

Olivier Jager, CEO, ForwardKeys, concluded: “The most striking feature of travel to the Middle East is the blue-chip nature of Dubai as a hub airport. It is the largest airport in the region by a long way and, despite the slowdown, it just keeps on growing.”

No Comments For This Post, Be first to write a Comment.

Most viewed from International

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Do you think Canada-India relations will improve under New PM Mark Carney?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)