2-day meeting of GST Council begins today

Thu 22 Dec 2016, 10:07:05

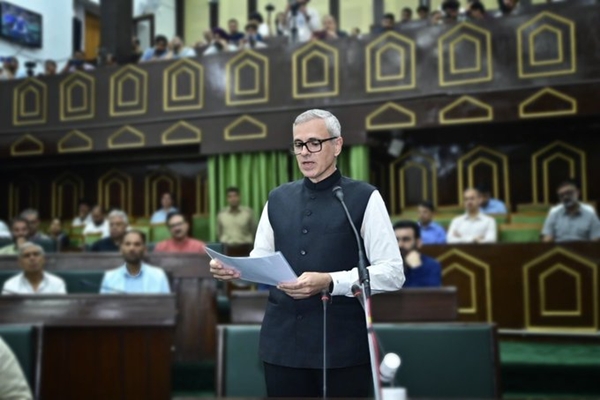

The GST Council will begin its two-day meeting in New Delhi today to consider the model GST laws and iron out differences on the issue of jurisdiction over assessees in the new indirect tax regime. This will be the seventh meeting of the Council and Union Finance Minister Arun Jaitley will chair the meeting.

GST Council in its last meeting had cleared 20 chapters of the model GST law and today they will discuss the remaining 7 chapters. Earlier, the council have taken several important decision. The decision includes the threshold limit of 20

lakh rupees exemption from levy of GST for normal States and 10 lakhs for the Special Category States.

lakh rupees exemption from levy of GST for normal States and 10 lakhs for the Special Category States.

Besides, to compensate States for 5 years for loss of revenue due to implementation of GST, the base year for the revenue of the State would be 2015-16 and a fixed growth rate of 14 per cent will be applied to it.

The government has time till 16th September next year to implement the Goods and Services Tax Act as per the Constitution Amendment Bill passed by both the Houses with two-thirds majority and by half of the States.

No Comments For This Post, Be first to write a Comment.

Most viewed from National

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Which Cricket team will win the IPL 2025 trophy?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.