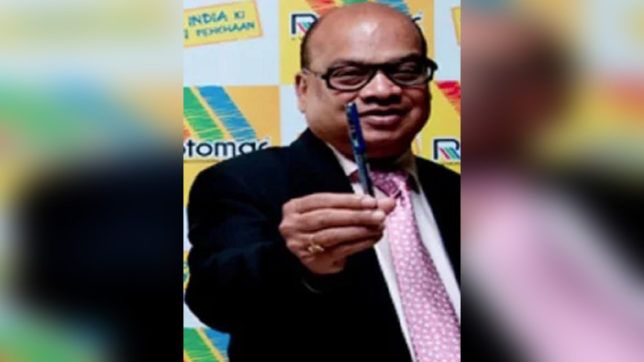

CBI raids office, house of Rotomac Pen owner in Rs.800 crore fraud case

Mon 19 Feb 2018, 12:39:21

The Central Bureau of Investigation (CBI) registered an FIR against Vikram Kothari, promoter of Rotomac Pen, for the loan default based on a Bank of Baroda complaint.

Earlier on Monday, raids were carried out at Kothari's office and residential premises in Kanpur in connection with the case.After billionaire jewellery designer Nirav Modi, another defaulter Kothari, had earlier denied reports of leaving the country.

The Kanpur-based company's owner had taken a loan of more than Rs 800 crore from over five state-owned banks, including Allahabad Bank, Bank of India and Union Bank of India.

According to local media reports, the promoter said speculation of his fleeing the country is baseless."I am a resident of Kanpur and I will stay in the city. However, I do have to travel to foreign countries for business purposes," Kothari said.

Kothari took a loan of Rs 485 crore from Mumbai-based Union Bank of India and a loan of Rs 352 crore from Kolkata- based Allahabad Bank.A year later, Kothari has reportedly not paid back either the interest or the loan.

In 2017, Bank of Baroda (BoB), a consortium partner declared pen manufacturer Rotomac Global Pvt Ltd as "wilful defaulter".

The company moved the Allahabad High Court seeking removal of its name from the list of wilful defaulters.

A division bench comprising Chief Justice DB Bhosle and Justice Yashwant

Verma had passed the order on a petition filed by the company, contending that it has been wrongly declared a "wilful defaulter" by BoB despite having "offered assets worth more than Rs 300 crore to the bank since the date of default".

Verma had passed the order on a petition filed by the company, contending that it has been wrongly declared a "wilful defaulter" by BoB despite having "offered assets worth more than Rs 300 crore to the bank since the date of default".

Rotomac was declared a wilful defaulter vide an order dated February 27, 2017, passed by an authorised committee, as per the procedure laid down by the Reserve Bank of India.

The development comes less than a week after Punjab National Bank (PNB) had detected a USD 1.77 billion (about Rs 11,400 crore) scam in which Modi allegedly acquired fraudulent Letters of Undertaking (LoUs) from a branch in Mumbai to secure overseas credit from other Indian lenders.

The PNB fraud pertains to issuance of fake LoUs to companies associated with billionaire jeweller Nirav Modi by errant PNB employees, which enabled these companies to raise buyer’s credit from international branches of other Indian lenders.

In January, PNB had lodged an FIR with the CBI stating that fraudulent LoUs worth Rs 280.7 crore were first issued on January 16. At the time, PNB had said it was digging into records to examine the magnitude of the fraud.

In the complaint, PNB had named three diamond firms - Diamonds R Us, Solar Exports and Stellar Diamonds - saying they had approached it on January 16 with a request for buyer’s credit for making payment to overseas suppliers.

No Comments For This Post, Be first to write a Comment.

Most viewed from National

Most viewed from World

AIMIM News

Delhi Assembly polls: Owaisi leads Padyatra in Okhla

Feb 01, 2025

We reject this Waqf Amendment Bill: Asaduddin Owaisi

Jan 30, 2025

Latest Urdu News

Most Viewed

May 26, 2020

Which team will win the ICC Men's Champions Trophy 2025 held in Pakistan/Dubai?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)