Consider service charge by hotels as income while assessing tax returns: Consumer Affairs Ministry

Wed 13 Sep 2017, 10:58:40

The Consumer Affairs Ministry has asked the Central Board of Direct Taxes to consider service charge by hotels and restaurants as income while assessing tax returns. At present, some hotels and restaurants are levying service charge in the range of 5 to 20 per cent despite the government's guidelines to make levy of such charge as optional.

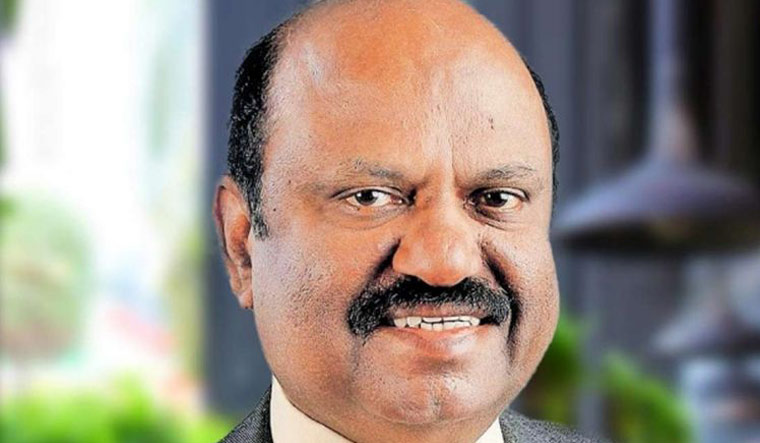

Consumer Affairs Minister Ram Vilas Paswan said in a tweet

that renowned hotel and restaurants have complied with the guidelines, but complaints are still being received through the National Consumer Helpline about service charge. He said, hotels and restaurants have been asked either to leave the column of service charge blank or mention on the bill that it is optional. Guidelines to hotels and restaurants for not levying service charge were issued in April.

that renowned hotel and restaurants have complied with the guidelines, but complaints are still being received through the National Consumer Helpline about service charge. He said, hotels and restaurants have been asked either to leave the column of service charge blank or mention on the bill that it is optional. Guidelines to hotels and restaurants for not levying service charge were issued in April.

No Comments For This Post, Be first to write a Comment.

Most viewed from National

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Do you think Canada-India relations will improve under New PM Mark Carney?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)