GST Council meeting in Hyderabad discusses tax reduction on Telangana govt flagship projects

Sat 09 Sep 2017, 16:54:35

A crucial meeting of the Goods and Services Tax (GST) Council was underway here on Saturday to discuss key issues relating to implementation of the new tax regime.

Chaired by Finance Minister Arun Jaitley, the 21st meeting of the GST Council was being attended by finance ministers of states and GST Secretariat officials.

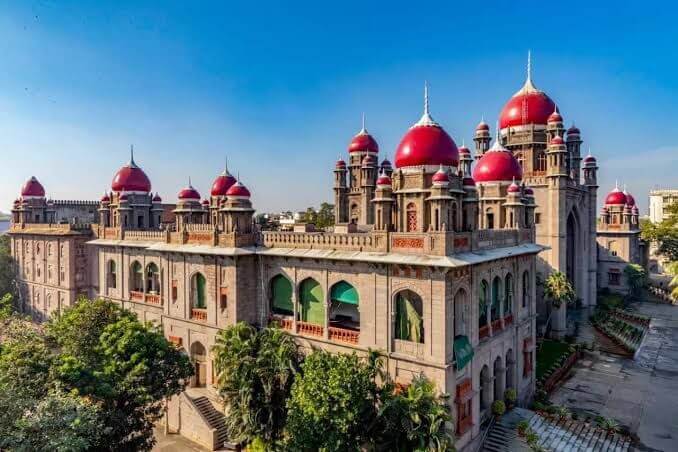

Over 150 delegates were attending the meet being held at the Hyderabad International Convention Centre (HICC).

The meeting is expected to take a decision on the demand of the Telangana government to reduce the GST to 5% on its flagship projects. At the previous meeting held in Delhi, the GST was reduced from 18% to 12%.

The Telangana government, however, insisted that the GST on ongoing projects should be brought down to 5% as the higher tax rate may put an additional burden of Rs 9,000 crore.

At one stage, Chief Minister K Chandrasekhar Rao had threatened to move the court over the issue. He later dashed off a letter to Prime Minister Narendra Modi.

Telangana is seeking the relief for public utility projects like irrigation schemes, Mission Kakatiya for restoration and revival of tanks and for

providing piped drinking water to every household and a two-bed room housing scheme for the poor.

providing piped drinking water to every household and a two-bed room housing scheme for the poor.

Telangana Finance Minister E. Rajender said the state would reiterate the demand for scrapping GST on ongoing work contracts or at least reducing it to 5%. The state is also seeking reduction in GST for the granite and marble industry and the beedi sector in view of their huge employment potential.

He said most of the states were supporting reduction in GST on public utility projects.

Telangana argues that its flagship projects were launched before July 1, when GST came into effect, and hence it will not be fair to impose a higher slab.

The meeting, the first to be hosted by Telangana, was also expected to discuss issues like passing on tax benefits to customers, setting up of the national and state-level anti-profiteering authorities, problems relating to online tax payments and delay in transfer of IGST and CGST amounts to states.

The GST Council over the last 10 months sorted out contentious issues and decided on a four-tier tax structure of 5, 12, 18 and 28%. Several sectors are still demanding that the council shift them to lower slabs.

No Comments For This Post, Be first to write a Comment.

Most viewed from National

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Do you think Canada-India relations will improve under New PM Mark Carney?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)