GST Council meets today in Srinagar to deliberate on tax rates

Thu 18 May 2017, 11:28:10

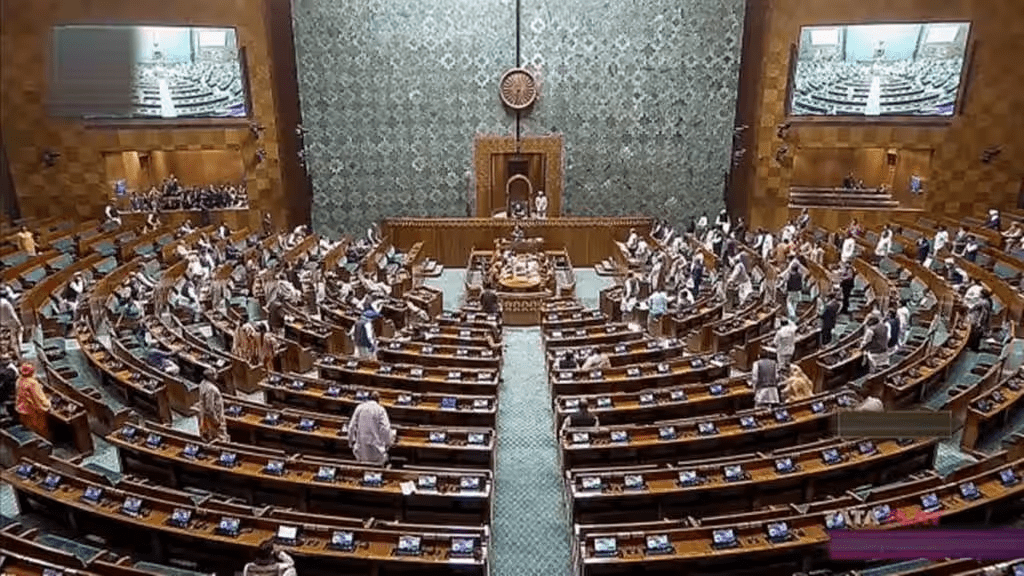

The Goods and Service Tax, GST Council will meet today in Srinagar to deliberate on tax rates on commodities and services. The meeting will be chaired by Union Finance Minister Arun Jaitley and it will be attended by the Finance Ministers of all States and Union Territories.

The meeting is seen significant as it will decide on the most important aspect of the GST that will have a bearing on common people.The Council over the next two days will fit most of goods and services in either 5, 12, 18 or 28 per cent tax bracket.

The new rates fixed

by the council will be charged from 1st of July, the scheduled date for rollout of Goods and Services Tax. The tax rates will be decided in a fashion to keep their impact on inflation as well as revenues to the government near neutral.

by the council will be charged from 1st of July, the scheduled date for rollout of Goods and Services Tax. The tax rates will be decided in a fashion to keep their impact on inflation as well as revenues to the government near neutral.

The GST will be a national sales tax that will be levied on consumption of goods or use of services.

It will replace seven central taxes like excise duty and service tax and nine state taxes like VAT and entertainment tax, thereby creating India as one market with one tax rate.

No Comments For This Post, Be first to write a Comment.

Most viewed from National

Most viewed from World

AIMIM News

Delhi Assembly polls: Owaisi leads Padyatra in Okhla

Feb 01, 2025

We reject this Waqf Amendment Bill: Asaduddin Owaisi

Jan 30, 2025

Latest Urdu News

Most Viewed

May 26, 2020

Which political party will win the Delhi Assembly polls to be held on Feb 5?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.