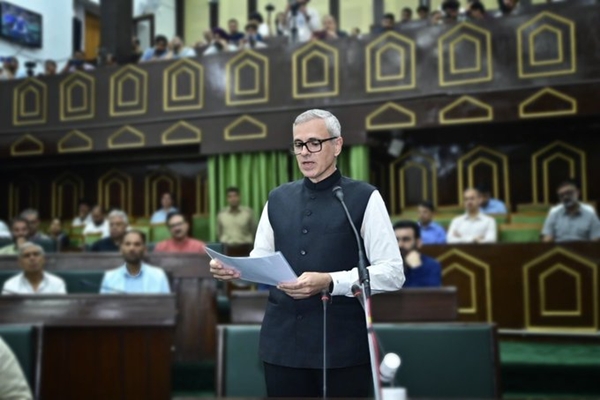

GST Council reaches consenses of state compensation

Wed 19 Oct 2016, 10:15:25

The Goods and Services Tax Council in its meeting reached at a consensus on the way the States would be compensated for any loss of revenue after implementation of the new indirect tax regime, GST from 1st of April next year.

Talking to reporters after first-day of the three-day deliberations in New Delhi yesterday, Union Finance Minister Arun Jaitley said that base year for calculating the revenue of a state would be 2015-16 and secular growth rate of 14 per cent would be taken for calculating the likely revenue of each state in the first five years of implementation of the GST. He said, states getting lower revenue than this would be compensated

by the Centre.

by the Centre.

The Minister said, the GST Council also discussed the possible Goods and Service Tax rates, including a four-slab structure with lower rates for essential items and highest band for luxury goods. Mr Jaitley said, the rate structure should be such which do not lead to further inflation and both the States and Centre have adequate funds to discharge their duties.

He said, the rate should be revenue-neutral so that there is no need to burden consumers with additional tax. Mr Jaitley said, the meeting has reached at a consensus on definition of revenue to compensate states for revenue loss due to GST implementation.

No Comments For This Post, Be first to write a Comment.

Most viewed from National

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Which Cricket team will win the IPL 2025 trophy?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)