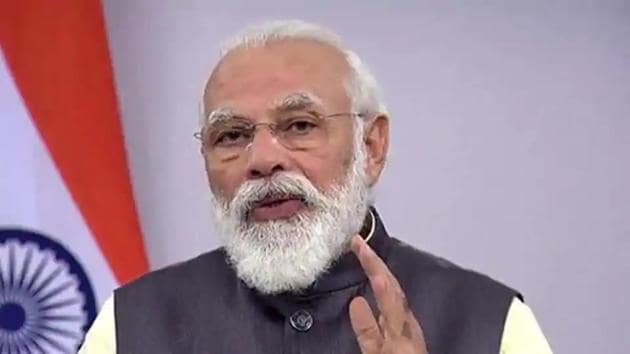

India’s Modi calls for move towards cashless society

Mon 28 Nov 2016, 15:01:10

INDIAN Prime Minister Narendra Modi on Sunday urged the nation’s small traders and daily wage earners to embrace digital payment channels, as a cash crunch following the government’s surprise ban on high-value bank notes drags on.

Modi, speaking in his monthly address on national radio, said the government understands that millions have been affected by the ban on 500-rupee and 1000-rupees notes, but defended the action.

SEE ALSO: Chaos in India as people rush to change nullified 500- and 1,000-rupee bank notes

The government says the bank-note ban announced on Nov. 8 is aimed at cracking down on corruption, people with unaccounted wealth, and counterfeiting of notes.

“I want to tell my small merchant brothers and sisters, this is the chance for you to enter the

digital world,” Modi said speaking in Hindi, urging them to use mobile banking applications and credit-card swipe machines.

digital world,” Modi said speaking in Hindi, urging them to use mobile banking applications and credit-card swipe machines.

“It’s correct that a 100 percent cashless society is not possible. But why don’t we make a beginning for a less-cash society in India?,” Modi said. “We can gradually move from a less-cash society to a cashless society.”

SEE ALSO: India’s reform architect trashes PM Modi’s cash crackdown

More than 90 percent of consumer purchases in India are transacted in cash, Credit Suisse estimates. While a smartphone boom and falling mobile data prices have led to a surge in digital payments in recent years, the base still remains low.

Modi urged technology-savvy young people to spare some time teaching others how to use digital payment platforms.

No Comments For This Post, Be first to write a Comment.

Most viewed from National

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Which Cricket team will win the IPL 2025 trophy?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)