INX Media case: Everything was clear in papers, ex-FIPB chairman Subbarao tells ED

Sat 24 Aug 2019, 16:27:46

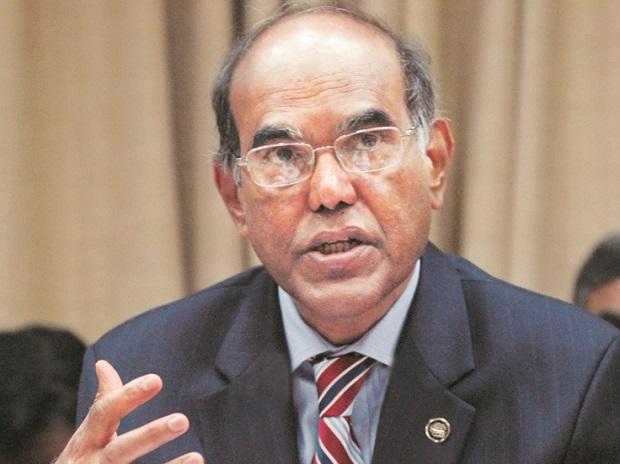

Former DEA secretary D Subbarao had told investigators probing the INX Media case that "violations" in the deal approving the Foreign Direct Investment (FDI) for the company were not brought to the notice of the Foreign Investment Promotion Board (FIPB), reveal official records.

Subbarao, who was the chairman of the FIPB which gave clearance to INX Media, recorded his statement under Section 161 of the CrPC saying "the non compliance of procedure by INX Media was not brought to the notice of the board, hence they were not aware of it."

"The two pages note prepared by the FIPB secretariat annexed with the application of INX Media also did not have any violation or non compliance details," Subbarao said in his statement.

He added, "Everything was clear in papers and hence the board recommended for approval to the then finance minister."

Other senior officials, who were responsible for the FIPB affairs at the time of this deal, had also said in their statements to probe agencies that violation of the FDI rules should have been referred to the RBI rather than being summarily approved.

The deal is being probed by the Enforcement Directorate (ED) and the Central Bureau of Investigation (CBI) on charges of alleged money laundering and corruption respectively. Former finance minister P Chidamabram has been arrested by the CBI in this case.

"The FIPB unit should have confirmed from the company if indeed downstream investment has been made in INX News Pvt Ltd," Subbarao, a 1972 batch IAS officer of the Andhra Pradesh cadre, said in his statement to the ED.

If the fact of downstream had been confirmed, it constituted a violation of the FIPB guidelines, the FIPB unit should have reported the matter to FIPB for an appropriate decision," Subbarao, who served as the 22nd Governor of Reserve Bank of India, had stated.

The secretary of the Department of Economic Affairs used to be the ex-officio chairman of the FIPB. The FIPB was scrapped by the Modi government in 2017.

Subbarao told investigators that normally a director deputy secretary of the FIPB secretariat is responsible for ensuring compliance with SEBI or RBI guidelines and to bring violations to the

notice of FIPB for decision on how to deal with the violation.

notice of FIPB for decision on how to deal with the violation.

"The normal practice in such cases was to refer then to RBI for adjudication under the Foreign Exchange Management Act. But the violation was not brought to the notice of the FIPB," Subbarao said in his statement, accessed by PTI, made under section 50 of the PMLA.

The probe agencies are counting this as a "clinching" evidence against Chidambaram and his son Karti, both of whom are accused in the case.

A statement made under the Prevention of Money Laundering Act (PMLA) is admissible in a court.

The probe agencies also found a case where a similar instance of downstream investment of the Tata NTT Docomo was referred to the RBI for action, but in the INX Media case the FEMA contravention was "regularised" and was allowed to escape the radar.

A probe report prepared by the agencies said that P Chidambaram, the then finance minister, "applied his mind at the time of according approval to the minutes of the meeting" of the FIPB under which INX Media was given the approval.

Dipak Kumar Singh, the then in-charge of the FIPB unit, said in his statement that INX Media had not sought approval for downstream investment but had mentioned their intent to make downstream investment upon completion of foreign investment for which approval of the FIPB was sought.

"INX Media should have mentioned in its applications that it would be issuing shares at premium while bringing in FDI if it had already decided that it would be issued to foreign investors at premium," the 1992-batch IAS officer of the Bihar cadre stated.

He was the in-charge of the FIPB unit between February, 2006 to December, 2010.

The INX Media got its FIPB approvals in 2007-08.

In case of violation of the FDI approval, Singh said in his statement, the normal course of action is "to refer the matter to RBI for appropriate action under FEMA." P K Bagga, OSD in the Ministry of Finance, said in his statement to the agency that if the FDI inflows were over and above the approved limit, the action in the normal course taken by the FIPB would be to refer the matter to the RBI for reconciliation or suitable action.

No Comments For This Post, Be first to write a Comment.

Most viewed from National

Most viewed from World

AIMIM News

Delhi Assembly polls: Owaisi leads Padyatra in Okhla

Feb 01, 2025

We reject this Waqf Amendment Bill: Asaduddin Owaisi

Jan 30, 2025

Latest Urdu News

Most Viewed

May 26, 2020

Which political party will win the Delhi Assembly polls to be held on Feb 5?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)