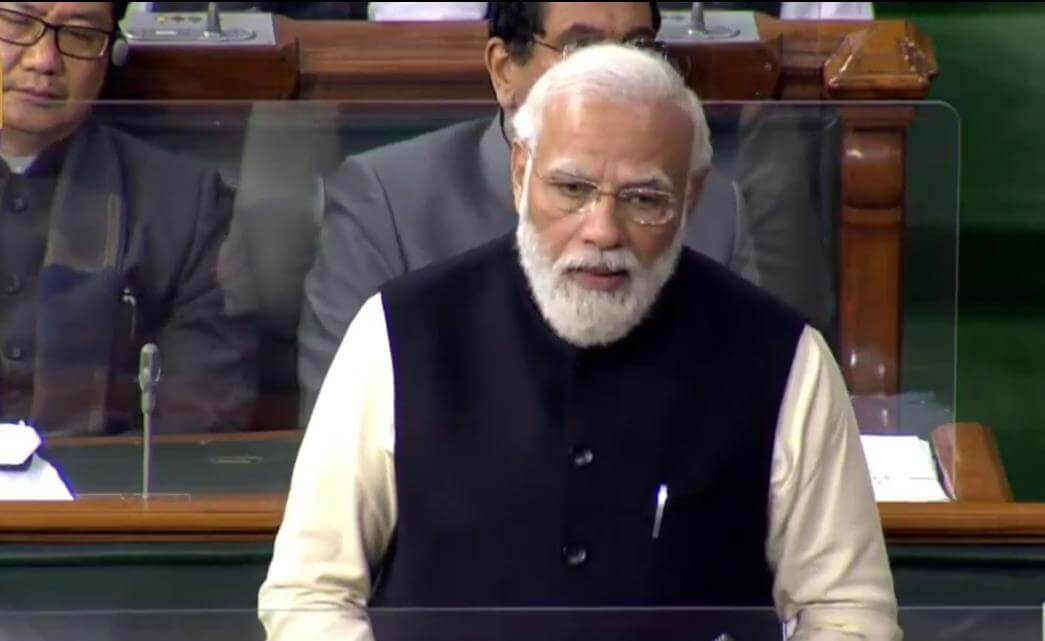

Lok Sabha passes taxation bill, taxpayers get relief

Sat 19 Sep 2020, 22:45:17

.jpg)

Lok Sabha on Saturday passed a taxation bill that seeks to provide various reliefs in terms of compliance requirements for taxpayers amid the coronavirus pandemic.

The reliefs include extending deadlines for filing returns and for linking PAN and Aadhaar.

The Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Bill, 2020, will replace the Taxation and other Laws (Relaxation of Certain Provisions) Ordinance, 2020, promulgated in March.

Among others, the bill seeks to

give tax exemption for contributions made to PM-CARES Fund, which was set up in March in the wake of the coronavirus pandemic.

give tax exemption for contributions made to PM-CARES Fund, which was set up in March in the wake of the coronavirus pandemic.

Replying to the debate on the bill, Finance Minister Nirmala Sitharaman said the ordinance was necessary to defer various compliance deadlines under GST and Income Tax (I-T) Act during the COVID-19 times.

Further, the bill seeks to make faceless assessment applicable to at least eight processes under the I-T Act, including for collection and recovery of tax and gathering of information.

No Comments For This Post, Be first to write a Comment.

Most viewed from National

Most viewed from World

AIMIM News

Delhi Assembly polls: Owaisi leads Padyatra in Okhla

Feb 01, 2025

We reject this Waqf Amendment Bill: Asaduddin Owaisi

Jan 30, 2025

Latest Urdu News

Most Viewed

May 26, 2020

Which team will win the ICC Men's Champions Trophy 2025 held in Pakistan/Dubai?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)