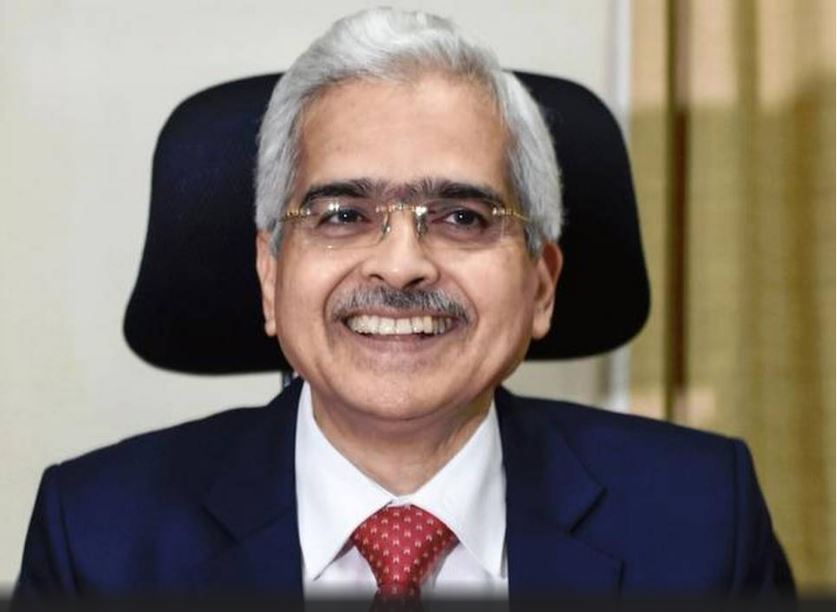

RBI reviewing monetary policy framework, says Shaktikanta Das

Sun 23 Feb 2020, 12:53:41

The Reserve Bank of India (RBI) is reviewing the retail inflation targeting framework behind monetary policy decision as well as its effectiveness and also plans to hold stakeholders consultations including with the government in June, Governor Shaktikanta Das said.

In a bid to keep inflation under specified level, the government in 2016 had decided to set up Monetary Policy Committee headed by RBI Governor entrusted with the task of fixing the benchmark policy rate (repo rate).

The six-member panel, which had its first meeting in October 2016, was given the mandate to maintain annual inflation at 4% until March 31, 2021 with an upper tolerance of 6% and a lower tolerance of 2%.

“The monetary policy framework is in operation for three and a half years. We have initiated a process of internal review of how the monetary policy framework has worked,” Mr. Das told PTI in an interview.

“We have commenced an internal review of the working of the monetary policy framework, and going forward by the middle of the current calendar year, that’s by June or so, we will be holding a round table with all analysts and experts and other stakeholders to do further consultations including the government at the appropriate time,” he said.

Obviously, the RBI has to interact with the government because the framework is a part of the law, he said, adding, “so, naturally government has to take a view”.

With regard to monetary policy transmission, the Governor said, it is steadily improving and is expected to improve

further.

further.

“Transmission is improving. If you see it was 49 basis points transmission for new loans in the December MPC. In February MPC, it has gone up to 69 basis points. So it is steadily improving,” he said.

On February 6, the six member-Monetary Policy Committee (MPC) headed by Mr. Das, for the second meeting in a row, kept repo rate unchanged at 5.15% but maintained accommodative policy stance which implies it was biased in favour of cutting rate to boost growth.

Prior to going for status quo on rates in December, the central bank had slashed rates five consecutive times that resulted in a cumulative 1.35% decline in repo rate.

On the RBI aligning its financial accounting year with that of union government, Mr. Das said, the current financial year will end in June while next financial year starting July one would end on March 31.

“So, the current year will go on till June. It will have 12 months. Next accounting year will start on July 1 and end on March 31,” he said.

So the central bank would prepare a truncated balance sheet for a period of nine months (from July 2020 to March 2021). Following next year, the full fiscal year of the RBI will start from April 1, 2021.

With this move, the RBI will do away with nearly eight decades of practice. The RBI, which was established in April 1935, used to follow January-December as its accounting year before it was changed to July-June in March 1940.

The change in accounting year is in line with the Bimal Jalan Committee on Economic Capital Framework (ECF) suggestion of a change in RBI’s accounting year to April-March from the financial year 2020-21.

It said the RBI would be able to provide better estimates of projected surplus transfers to the government for the financial year for budgeting purposes.

No Comments For This Post, Be first to write a Comment.

Most viewed from National

Most viewed from World

AIMIM News

Delhi Assembly polls: Owaisi leads Padyatra in Okhla

Feb 01, 2025

We reject this Waqf Amendment Bill: Asaduddin Owaisi

Jan 30, 2025

Latest Urdu News

Most Viewed

May 26, 2020

Which team will win the ICC Men's Champions Trophy 2025 held in Pakistan/Dubai?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)