Still to get Rs 110 crore for recalibrating ATMs after Nov 8: Cash logistics firms

Thu 06 Apr 2017, 15:07:31

According to sources, at least 90 per cent of the banks have deferred payments, stating that services pertaining to ATM recalibration and retrieval of old cash are not a part of their contract with the logistics firms.

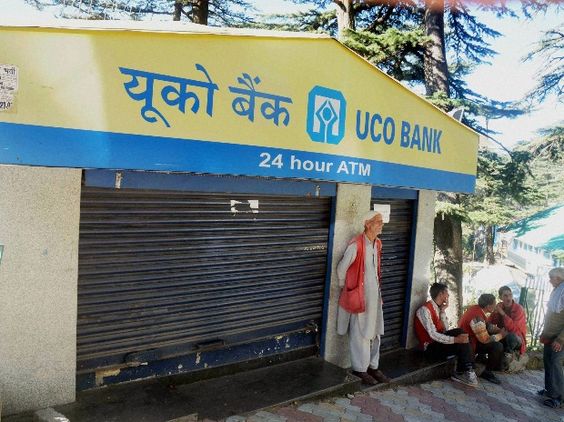

Cash logistics firms engaged in the recalibration of Automatic Teller Machines and retrieval of scrapped currency notes from ATMs in the weeks that followed the withdrawal of Rs 500 and Rs 1,000 notes on November 8 are now saddled with unpaid bills from banks of up to Rs 110 crore, sources told .

A majority of banks have questioned the cost incurred by the firms between November 10 and December 30, 2016, said three persons familiar with the

development.

development.

According to sources, at least 90 per cent of the banks have deferred payments, stating that services pertaining to ATM recalibration and retrieval of old cash are not a part of their contract with the logistics firms.

State Bank of India (SBI), which is heading a task force on this issue, said that it is yet to receive any bills, which have to be routed through managed service providers (MSPs) who outsource the job of refilling to cash logistics firms.

Some banks have deferred payments as they believe the service provided by the logistics firms during demonetisation were in national interest, said sources. A number of banks have referred the issue to their boards to take a decision, they said.

No Comments For This Post, Be first to write a Comment.

Most viewed from National

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Can Lionel Messi's visit boost Indian football?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2026 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)