With GST, India takes a leap towards 'one nation one tax'

Sat 01 Jul 2017, 00:26:24

NEW DELHI: The midnight launch of the Goods and Services Tax (GST), the biggest tax reform since independence, catapults India into a select league of nations that have a national sales tax.

Amid boycott of the launch ceremony by principal opposition parties like the Congress which termed it as "tamasha" (gimmick), the new tax regime overnight replaces the messy mix of more than a dozen state and central levies built up over seven decades.

The one national GST unifies the country's $2 trillion economy and 1.3 billion people into a common market, an exercise that took 17 tumultuous years.

The GST will eliminate the compounding effect of the current multi-layered tax system as well as the cross-state tax heterogeneity by fixing the final tax rate. It is expected to lower the average tax rate on manufactured goods and make them uniform across states by fixing the final tax rate.

While the measure is billed as making doing business easier by simplifying the tax structure and ensuring greater compliance, businesses particularly small traders have been a bit nervous about the new tax filing system.

A train was stopped by traders in Uttar Pradesh and commercial establishments and wholesale commodity markets in some cities remained closed today in protest against the "hasty" rollout of GST.

While a general strike by traders in Kashmir has been called tomorrow, Uttar Pradesh and Madhya Pradesh witnessed sporadic bandhs. West Bengal, Andhra Pradesh and Telangana also witnessed protests.

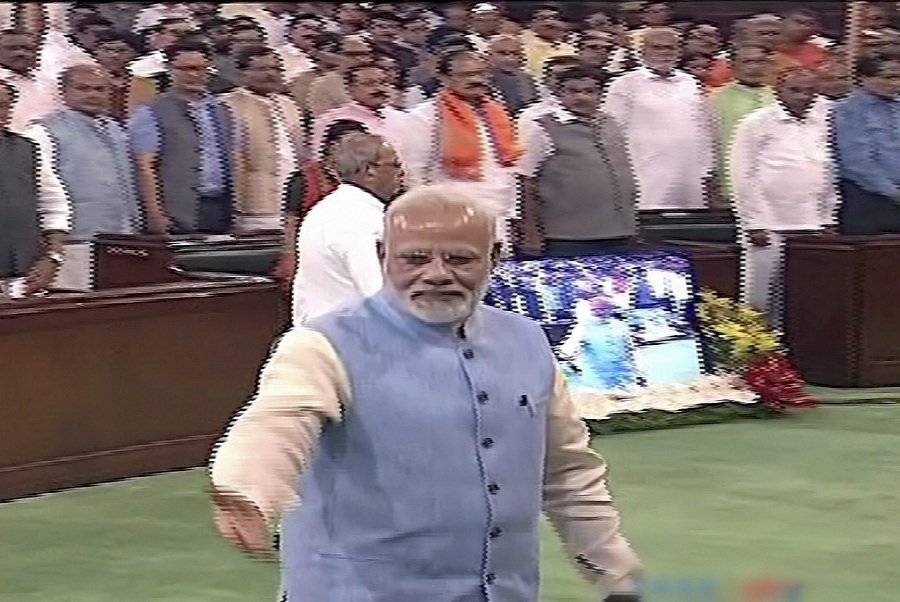

The Congress termed the starry midnight launch attended by President Pranab Mukherjee, Prime Minister Narendra Modi, Vice-President Hamid Ansari, Lok Sabha Speaker Sumitra Mahajan and former prime minister H D Deva Gowda besides Bollywood superstar Amitabh Bachchan, country's most famous singer Lata Mangeshkar and industrialist Ratan Tata, as "tamasha" saying it was being rushed in a "half-baked" manner as a "self- promotional spectacle".

TMC's Mamata Banerjee feared it would bring back the dreaded "Inspector Raj".

But NCP, JD(U) and JD(S) broke ranks with opposition parties to attend the launch ceremony. Besides the Congress, other parties that boycotted the event included RJD, DMK and Left parties.

Unlike the last midnight event held in 1997 on the occasion of golden jubilee of the Independence at a special session of Parliament, it will

be a gala event at the circular -shaped hall that has been loaned for the launch of the historic reform.

be a gala event at the circular -shaped hall that has been loaned for the launch of the historic reform.

The government promises that the transition to a single, nationwide tax on goods and services will streamline business and boost the economy by tearing down barriers between 31 states and union territories. It is estimated to add 0.4 per cent to 2 per cent to GDP growth.

But some businesses are still figuring out how it will work as they race against time to adopt or upgrade cash registers and computer systems so they are able to file monthly tax returns to comply with the new tax regime.

Hours before the midnight launch, the GST Council - the highest decision making body that formulated the rules and tax rates, met for the 18th time. Prime Minister Narendra Modi joined the council members briefly.

For some businesses, the GST is complex with four broad tax categories of 5, 12, 18 and 28 per cent, and myriad exceptions, as opposed to a simpler, flatter and broader sales taxes in other countries.

Switchover to the GST has added to the worries of businesses that are still recovering from the November 8 shock decision to remove 86 per cent of currency from circulation.

One of the things that is keeping companies occupied ahead of the launch is calculation of input tax credit, which allows them to claim refunds on tax paid on inputs and pay tax on the value adds only. From soft drink makers to automobile firms, companies are busy calculating final consumer price to be charged from July 1.

The government, however, defends the decision saying enough time was given to businesses to adapt to the new regime.

Notwithstanding this, the government will take a lenient view for tax returns filed in the initial period.

First proposed in 2003, the idea of GST was bogged down for years in bipartisan debate, with political parties in government trying to push it and those in opposition dragging it down. Before Modi came to power three years ago, his party was not particularly in favour of the GST.

Over 1,200 items, from shampoo to tea to automobiles, have been put in four broad tax categories.

Unbranded food staples including vegetables, milk, eggs and flour will be exempt from GST, along with health and education services. Tea, edible oils, sugar, textiles and baby formula will attract a 5 per cent tax.

No Comments For This Post, Be first to write a Comment.

Most viewed from National

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Do you think Canada-India relations will improve under New PM Mark Carney?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)