Proposal to tax EPF withdrawn

Tue 08 Mar 2016, 12:59:29

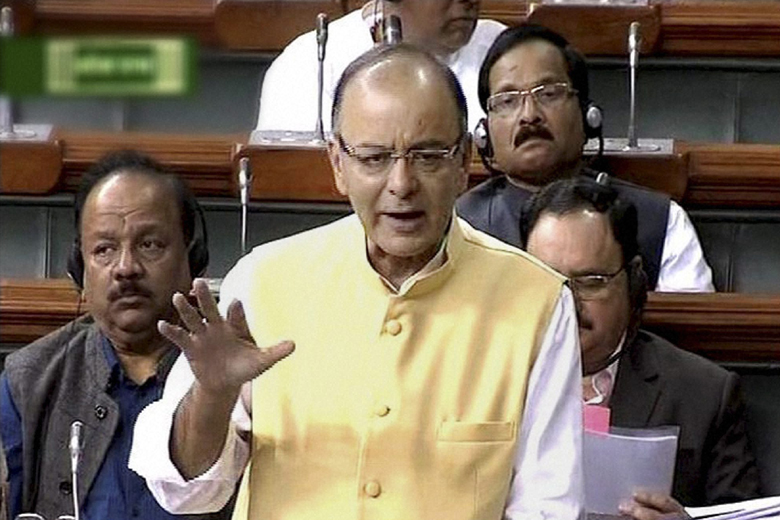

Facing all around attack, Finance Minister Arun Jaitley today withdrew his Budget proposal to tax employees' provident fund (EPF) at withdrawal.

Jaitley had in his Budget for 2016-17 proposed to tax withdrawal of 60 per cent of accumulations in the employee provident fund after April 1, 2016.

This was criticised by all employees unions as well as political parties.

"In view of representations received, the government would like to do a comprehensive review of this proposal and therefore I withdraw the proposal," Jaitley said in a suo motu statement in Lok Sabha.

He however stated that 40 per cent exemption given to National Pension Scheme (NPS) subscriber at the time of withdrawal remains.

In his budget proposal, Jaitley had proposed that 40 per cent of the EPF withdrawals would be tax exempt and the

remaining 60 per cent would also get the same treatment provided the amount is invested in pension annuity schemes. This proposal was criticised by the parties and the unions which said it amounted to forcing employees to invest in pension annuity schemes.

remaining 60 per cent would also get the same treatment provided the amount is invested in pension annuity schemes. This proposal was criticised by the parties and the unions which said it amounted to forcing employees to invest in pension annuity schemes.

"Employees should have the choice of where to invest. Theoretically such freedom is desirable, but it is important the government to achieve policy objective by instrumentality of taxation. In the present form, the policy objective is not to get more revenue but to encourage people to join the pension scheme," Jaitley said explaining the rationale for the taxation proposal.

The proposal would not have impacted 3.26 crore EPFO subscribers drawing statutory wage of upto Rs 15,000 per month. Employees Provident Fund Organisation (EPFO) has a total subscriber base of 3.7 crore.

No Comments For This Post, Be first to write a Comment.

Most viewed from Specials

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Do you think Canada-India relations will improve under New PM Mark Carney?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2025 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)